Chadha Papers: Surge in new capacities drives shift from 18 BF paper to cup stock and bleached craft

-Setting up a New Coating Line to produce Thermal, C1S and Cupstock paper

Exploring the dynamics of Chadha Papers: a candid interview on overcoming challenges, embracing innovation, and navigating the evolving paper industry. gain insights into the resilient journey of Chadha Papers, from its inception in 1991 to adapting to market fluctuations, shifting production focus, and spearheading eco-friendly practices. Join us as we delve into the visionary strategies, market perspectives, and future outlook with Mr. Amanbir Singh Sethi, Director, Chadha Papers Ltd. , the driving force behind Chadha Papers

The Pulp and Paper Times

Q: Give us a small introduction to your Chadha Papers.

Chadha Papers commenced production in 1991 but faced discontinuation in 2004 or 2008 due to family issues. In 2013, ownership transitioned within the family, and since then, I have been overseeing its operations. We specialize in manufacturing writing, printing, and craft grades, namely absorbent. Additionally, we've ventured into craft paper bags over the past 1-2 years. We are established suppliers in writing and printing to various government establishments, numerous states in India, and, of course, the market.

Q: In recent times, there have been ups and downs in imported waste paper prices. How did you manage those fluctuations successfully?

It was undoubtedly challenging. When the price of craft paper suddenly dropped by about $200-$300 within 2-3 months, it posed the toughest period for us, resulting in significant financial losses. Despite this, our partners and suppliers stood by us. By adapting to new rates and introducing new materials, we adopted an aggressive stance in the market, overcoming the challenges. The COVID period was particularly tough for writing and printing, but post-COVID, the segment has stabilized, aiding our recovery.

Q: Overcapacity has emerged in the market, impacting existing paper mills' production capacity. Do you believe overcapacity poses a threat to new expansion?

Absolutely, 101%. The influx of new capacities in the market raises concerns. We have already transitioned from 18 BF paper and are actively shifting our capacities to other products like cup stocks and bleached craft. Our focus on paper bags in North India has proven successful. Additionally, we are enhancing our writing and printing grades.

Q: Many paper mills are expanding their portfolios into different segments to mitigate competition. Is there any work being done in this area?

Certainly, we are constantly striving for value addition. Our efforts include venturing into cup stock, bleached craft, and producing C-grade absorbent. We are also investing in new machinery to recycle various raw materials and adopting eco-friendly practices. Setting up new coating lines for value-added products like thermal paper, C1S, sublimation paper, and biodegradable cup stock coating is part of our innovation strategy.

I think that is the future because PE is in a position to be banned at any time. We have already heard about it in a couple of states. If we don't do all this innovation, especially being a mill which is up north, I don't see a good future.

Q: Export from India has decreased. Do you think it can be stopped permanently, or only those with quality paper can export?

Quality paper will always hold value, and we must strive for that. However, international scenarios, especially fuel prices, play a significant role. If issues arise in Europe, India may find opportunities in Africa or the Gulf market based on fuel prices. But in the end, again, those who have this much overcapacity and those who have quality paper will be able to make their own place.

Q: There has been a significant increase in packaging paper capacity in South East Asia and Europe. Is the export scenario from India completely over?

Yes, it is essentially done. The focus is now on value-added products.

Q: Do you think excess capacity will be offset in a couple of years?

While growth will persist, some mills are wisely opting to shut down, realizing the impracticality of burning money.

Q: Odour is a significant problem in the paper sector. How do you address the odour or smell issue?

We have taken extensive measures to address odour problems. With land discharge permission, we've established a 100-acre Eucalyptus plantation around our mill. Our ETP is up to date, and after controlling DOD and COD levels, we utilize our own water for irrigation, contributing to the green belt surrounding us.

Q: What is the scenario of waste paper? Can it go down further, or will the market go up?

My personal intuition is that capacity is still increasing; You are still hearing that around 1000 tons per day plants are under process of commencement. I think it will go ahead and tighten.

Global compostable packaging overview and trends

The Pulp and Paper Times

Compostable products are materials that can biodegrade and disintegrate into natural elements in a composting environment, leaving no harmful residues. To qualify as compostable, packaging materials and products must break down completely and convert into natural elements within a short period following disposal.

North America is the leading market player in the global compostable packaging sector (by revenues and market share) while Asia Pacific is the largest (by volume), a trend that is likely to be sustained. The global compostable packaging market was USD 46.36 billion in 2021 and is estimated to grow to USD 75 billion by 2029, a CAGR of 6.20%. With government policies directed at sustainable packaging, a rapid growth in the global compostable packaging market is forecast. The rise of e-commerce and online food orders, the compostable packaging market is expected to expand 1.5x during the projected period.

Compostable packaging drivers

Online retail: Online shopping has expanded in China, India, Brazil, ASEAN and others due to the widening use of smartphones leading to online shopping translating into enhanced use of corrugated boxes and paper bags.Literacy: India’s literacy rate is 77 percent. The government has allocated INR 1,12,899 crores to education in the Union Budget 2023. This quantum is expected to widen the market for eco-friendly packaging awareness.

E-commerce: The Indian e-commerce market is expected to grow from USD 74.8 billion in 2022 to USD 350 billion by 2030, influencing the use of sustainable packaging.

Rising population: India’s population has surpassed China and is estimated at 1.41 billion, catalyzing the Indian packaging sector.

Demographic dividend: The Indian population’s median age is now at 28.4 years in 2022 as against 30 years of global average, strengthening the offtake of green packaging products

Restaurant takeaway: The Indian food and beverage packaging market stood at USD 31.75 billion in 2022. Between 2023 to 2029, Indian food and beverage packaging market size is expected to grow at a CAGR of 14.8 percent growing to USD 85.9 billion by 2029. Higher standard of living and fast paced urban life are the factors which are contributing to the growth of online food delivery paired with packaged food.

Organized retail: By 2032, the retail industry is expected to be worth a staggering USD 2 trillion. The percentage of contemporary retail (including e-commerce) is predicted to rise to 35 percent, while traditional retail is anticipated to decline to 65 percent, despite the fact that the industry is mostly unorganized. India’s per capita net national income is estimated to be INR 172,000 yearly for FY 2022- 23, recording a growth of 14.4 percent over the previous year.

Indian packaging industry overview

The growth in the Indian packaging industry has been catalyzed by a surge in e-commerce, food processing, pharmaceuticals, FMCG, manufacturing and health care sectors. The Indian government’s ‘Make in India’ initiative has catalyzed the packaging industry and the country’s paper and packaging industry is the fifth largest sector in the economy.

India is a major exporter of flattened cans, printed sheets, components, crown cork, lug caps, plastic film laminates, craft paper, paperboard and packaging machinery. The laminates and flexible packaging segment, particularly PET and woven sacks are growing fastest. Packaging-grade paper accounts for 55 percent of the main types of paper produced domestically in the paper and paperboard industry. India is a significant player in the global packaging materials market, catalyzing exports.

India’s export of packaging materials grew at a CAGR of 9.9 percent to USD 1,119 million in 2021-22 up from USD 844 million in 2018-19. United States was the leading export destination for the Indian packaging industry, followed by United Kingdom, United Arab Emirates, Netherlands and Germany.

The Indian paper and paperboard market is also predicted to expand at 6-7% annually. Source: ibef.org, niir.org) India’s paper and packaging industry is expected to grow to a value of $204.81 billion by 2025, with a CAGR of 26.7% from 2020 to 2025.

The above report has been extracted from the Pakka Limited’s Annual report for FY 22-23

Emami Paper: Chinese mills flooded the South-East Asian market with their paper products, resulting in a loss of nearly 30% of market share for companies in India

-Annual Progress Report for FY 22-23:

-Company’s export sale stood at INR 270 crore compared to INR 586 crore in immediately preceding financial year

- A size press successfully retrofitted in the largest newsprint machine of Emami Paper Mills making it suitable for producing other grades of papers

The Pulp and Paper Times:Emami Paper Mills (EPM) is one of the largest newsprint manufacturers in the country as well as a leading manufacturer of Packaging Board and Writing & Printing Paper. Having a rich legacy of delivering superior quality products.

Setting aside the conventional approach, the Emami Paper of today believes in informing and educating its stakeholders. EPM is transparently sharing financial performances, operational metrics and procurement strategies within the organisation and it has created deeper engagements of various teams within the organisation. The cross-functional synergies derived from these efforts inspire us to set more precise targets and aim for greater goals.

“Over the past year, we have continuously reiterated our commitment towards excellence, innovation and sustainability with a greater focus on adapting ourselves to an evolving business landscape. We have adopted a proactive approach to understand client expectations, improved our capacity to develop new-age products and above all, kept an unwavering focus on abiding by the highest standards of quality. Alongside, our focus on ensuring customer satisfaction drives us to operate with great passion, enabling us to produce customised products and consistently create new revenue generation streams. Besides, it forges enduring relationships and earns us the trust and loyalty of a marquee clientele,” said by Mr. Aditya V. Agarwal, Executive Chairman of Emami Paper in the annual report for FY 22-23.

Mr Agarwal further added, “As a responsible business, we believe in not just pursuing profitability, but also take into account its impact on the environment and society. By undertaking initiatives for the welfare of communities, optimising resource utilisation, and embracing viable methods to minimise our imprint on the planet, we are actively contributing to a greener and more sustainable future.”

During the fiscal year, EPM revenue grew by 18%, reaching INR 2,308 crore. The EBITDA and PAT stood at INR 237 crore and INR 69 crore respectively in the previous fiscal year.

“Reflecting on the past year, while the first half favored us, the latter part did not progress as expected. Several factors contributed to this, including the unprecedented increase in the price of pulp, our key raw material. The Russia-Ukraine conflict and the COVID-19 outbreak in China were among the reasons for this surge. Additionally, the domestic consumption of pulp declined, and Chinese mills flooded the South-East Asian market with their paper products, leading to a significant impact on our sales. This region accounts for 20%-30% of Indian exports, resulting in a loss of nearly 30% of market share for companies in India. Moreover, the energy crisis in the Euro region posed a threat to our industry,” said Mr. Vivek Chawla, Whole-time Director & Chief Executive Officer.

Mr. Chawla further added about Focus on innovation and digitization, he said, “Focus on innovation and digitization remains a top priority for Emami Paper Mills. We understand that innovation is the key to remaining competitive in an ever-evolving paper industry. To foster innovation, we have established a dynamic Product Development Cell, dedicated to creating innovative paper products that meet the diverse needs of our customers while driving profitability. This emphasis on quality and customization ensures we deliver high-quality products that stand out in the market”.

On the way forward, Mr. Chawla described that our unwavering commitment to quality, customer engagement, cost optimization, and operational efficiency will continue to be the cornerstones of our success. By consistently delivering high-quality products and services, engaging with our customers to understand their evolving needs, optimizing our costs, and driving operational efficiency, we are confident that we will achieve sustainable growth in the years to come.

Emami Paper Mills recognizes the importance of technology as a catalyst for progress. Through continuous investment in technology, EPM aims to enhance productivity, streamline processes, and ensure efficient resource utilization. By leveraging technology, EPM will stay at the forefront of innovation and reinforce its position as a leader in the industry.

Environmental stewardship is another key pillar of Emami Paper Mills' sustainability strategy. Given the nature of our industry, it is crucial to find ways to reduce freshwater consumption. To this end, Emami Paper Mills has set internal targets to increase the share of recycled water used in paper production processes. We are also implementing energy-efficient practices by employing state-of-the-art energy meters to monitor and curtail energy usage. These initiatives reduce our carbon footprint and minimize our impact on the environment, aligning with Emami Paper Mills' long-term sustainability goals.

EPM’s total production capacity stands at 3,40,000 tons per annum. It has also established a captive power plant generating 33.5 MW power, thereby ensuring self-sufficiency in meeting our energy and steam demands. EPM produces 2,00,000 tons per annum of multilayer coated packaging board and have a combined capacity to manufacture 1,40,000 tons per annum of superior quality writing and printing paper along with best-in-class newsprint.

During FY 22-23, the export sales of the Company declined mainly due to increase in export from China to the Southeast market at throwaway prices where the paper industry in India was exporting. This led to sharp fall in the prices of the Paper Board in the countries where the Company was exporting. In FY 2022-23, the Company’s export sale stood at INR 270 crore compared to INR 586 crore in immediately preceding financial year.

During FY 2022-23, EPM witnessed a significant impact from the rising prices of major imported raw materials such as pulp, waste paper and fuel. Amidst a trend of global greenflation, there has been also a surge in freight rates and container costs. Currently, we are sourcing raw materials from countries like United States of America, United Kingdom, Canada, New Zealand, Indonesia, etc. During the pandemic period and even thereafter, there were bottlenecks with regards to supply chain which is gradually now streamlining.

A size press successfully retrofitted in the largest newsprint machine of Emami Paper Mills making it suitable for producing other grades of papers. The trial run has been successfully completed. For the first time in the Indian Paper Industry, such a project in a running mill was successfully commissioned. With the successful commissioning of size press, the company was able to cater to the increasing market demand in the writing and printing paper segment apart from Newsprint. The writing and printing paper segment gave a good realization.

The Report further added that the paperboard and industrial packaging paper markets, as well as the newspaper print markets, are estimated to account for over 70% of the total paper market share. However, the stationery paper and speciality paper sectors are predicted to experience an upward trend in annual market growth in terms of volume, while the growth of the stationery paper market in terms of value is likely to decline. At present, the growing demand for environment-friendly products is driving manufacturers to seek effective ways to meet this emerging demand. The paper industry is benefiting from technological advancements, which have resulted in improved production capacity and reduced fuel costs, among other advantages, thus enabling the industry to scale new heights.3 The pandemic adversely impacted paper consumption, leading to a sharp decline. However, demand has recuperated strongly in the current fiscal year, surpassing prepandemic levels.

Holmen: Wood prices are now 30 per cent higher than the historical average; combining its paperboard and paper into a single business area, strengthening book paper business

Holmen is a Swedish forest company that gives quality-conscious customers across the world access to renewable products from the Swedish forests. Holman manages the forest actively and sustainably, and use the raw material wisely and far-sightedly. The wood is refined into wood products for sustainable building, and turns whatever is left over into paperboard of world-leading quality and innovative paper products.

2023 was defined by the central banks’ attempts to combat inflation through interest rate rises, which slowed the pace of newbuild construction and stifled consumption. Despite the challenging economic environment, we were able to maintain operating profit for 2023 at a historically good level of SEK 4 755 million, says Mr Henrik Sjölund, President and CEO, Holmen

Higher interest rates contributed to a decline in demand in the previous year, but our business model − creating value based on our forest assets − has proven successful even during these tougher times. With our large forest holdings as a foundation, we grow houses while also harnessing the energy that blows over the treetops and flows in the rivers. We then make renewable packaging, magazines and books from the residual forestry products.

In light of the solid earnings and our strong financial position, the Board of Directors proposes that the dividend per share be increased from SEK 8 to SEK 8.5, with the payment of an extra dividend of SEK 3.

Forest and energy are in-demand resources

The forest has a key role to play in the climate transition and demand for both logs and pulpwood is expected to increase. Although the industry has not been running at its peak, competition in the wood market across the Nordic region remains high and prices climbed further in 2023. Wood prices are now 30 per cent higher than the historical average, and the value of Holmen’s Forest properties has increased by SEK 4 billion to SEK 56 billion. With a little over a million hectares of productive forest land, we have a much sought after resource that literally grows year on year. Our position in the wood market, with good control over raw materials and the entire value chain, ensures the long-term security of our raw material supplies and gives us good opportunities to continue developing our industries.

The European energy market is undergoing a major transition. Roughly half of today’s electricity production in Europe is fossil free, but electricity only accounts for a quarter of total energy consumption and almost all other energy consumption is fossil based. Europe has accelerated its climate transition and is beginning to pave the way for new green industry. As a result, considerable renewable electricity production is going to be needed, and Holmen is continuing to pursue permits for new wind turbines on its own land. Our hydro power additionally contributes to the production of electricity at times of peak demand in order to stabilise the grid. The role of controllable hydro power is also going to become increasingly important as more weather dependent electricity production is added to the energy mix. The energy situation in Europe improved over the year thanks to good gas stocks, lower production levels in energy intensive industries and a milder winter. Continental electricity and energy prices have also stabilised, but at a higher level than before the energy crisis.

There is significant potential for Holmen to deliver more renewable energy, but to realise this, we need permits from the authorities. I really hope politicians will speed up the permit processes, for the sake of Sweden and the green transition. I am pleased to report that in 2023 we obtained permits for two new wind farms. In the first phase we intend to build Blisterliden Wind Farm in Västerbotten for a 20 per cent boost to our production of wind and hydro power. Alongside this, we are also beginning work with Vattenfall on Stormyrberget Wind Farm in Västernorrland, a project that may be ready for an investment decision by 2025.

Adding value at our own facilities Buildings account for considerable emissions of greenhouse gases, in construction and during the building’s lifecycle. As a building material, wood is benefitting from the ongoing transition to more sustainable building, in a trend that is expected to drive up demand for wood products, particularly if concrete and steel are made to carry their true cost to the climate. There is considerable interest in large-scale wood construction, but demand from the rest of the construction market was subdued over the year due to high interest rates. Given our strong position in the wood market, we see good opportunities to develop the wood products business in pace with the increasing demand for sustainable building materials. The first step is to increase capacity at Iggesund Sawmill, and to ramp up the production of glulam and CLT.

Over the years, Holmen has succeeded in developing both paper and paperboard based on fresh wood raw material and a largely fossil-free production process. Our well-invested facilities, access to fossil-free electricity and local wood make us highly competitive, and we are continuing to develop our process industry. Within paperboard, we have excellent opportunities to grow the premium business over time, while in paper we are investing to strengthen our book paper business while also launching a new product for transport packaging.

To further increase our competitiveness and strategic capabilities, we are now combining paperboard and paper into a single business area – Holmen Board and Paper. This move sees us focusing our business model on four distinct business lines: forestry, hydro and wind power, woodworking industry and process industry operations.

Well equipped for the future

Holmen’s strategy draws on the fact that the world is transitioning towards using energy and materials sustainably. Our growing forests bind carbon dioxide and all our products help to replace fossil-based materials such as concrete, steel and plastic. Our electricity production makes it possible for people to charge their electric cars and for companies to run their production on renewable energy sources. Our positive climate impact for 2023 equated to 7.5 million tonnes of CO2eOur strong financial position makes Holmen well placed to succeed even during tough economic times. Backed up by our own forest and energy production, we have been able to continue developing and advancing our business despite global uncertainties. And that is going to continue.

The above review of Mr Henrik Sjölund, President and CEO, Holmen, has been extracted from the annual report of SAC for FY 2023

Valmet to deliver advanced tissue line to Andhra Paper’s kadiyam mill

The Pulp and Paper Times | 26 June 2024

Valmet is to deliver an Advantage DCT100HS tissue line to Andhra Paper Limited for its Kadiyam mill in Andhra Pradesh, India. The new line is optimized to enhance production and reduce environmental footprint. The start-up is scheduled for the end of 2025.

The order is included in Valmet's orders received of the second quarter 2024. The value of the order will not be disclosed.

“This strategic investment proves our commitment to innovation, sustainability, and meeting the evolving needs of our customers. The decision to invest in cutting-edge technology from Valmet underscores our dedication to enhancing our production capabilities while reducing our environmental footprint. The new tissue machine will leverage advanced engineering and design to maximize efficiency and productivity, ensuring that we continue to deliver high-quality products to our valued customers,” says Mukesh Jain, Executive Director, Andhra Paper Limited.

“It is a privilege to cooperate with Andhra Paper and deliver them world leading Valmet Advantage DCT technologies. We are looking forward to working together to make the new tissue line successful,” says Jenny Lahti Samuelsson, Vice President Tissue Mills Sales, Paper business line, Valmet.

“We are very proud to be chosen as the supplier and partner for Andhra Paper’s expansion. The order reaffirms our position as a leader in the tissue industry, empowering us to maintain a competitive edge in both domestic and international markets,” says Timo Honkanen, Vice President, Paper Business, Asia Pacific, Valmet.

Delivery’s technical information

Valmet's scope of delivery will comprise an Advantage DCT 100HS tissue machine equipped with an OptiFlo TIS II headbox and an Advantage Steel Yankee Dryer. The machine will feature Advantage tissue technologies, including an Advantage ReDry, an Advantage ViscoNip Press, a gas heated AirCap hood, rewinders and process equipment. In addition, the delivery includes Valmet’s automation with Valmet DNA Distributed Control System (DCS) and Valmet IQ Quality Control System (QCS).The tissue machine will have a paper width on reel of 2,850 mm, a maximum operating speed of 6,560 ft/min (2000 m/min), and a yearly capacity of 35,000 tons of high-quality tissue grades dedicated for bath, towel, facial and napkin products.

The consumer goods industry is moving towards replacing plastic-based packaging materials with molded fiber-based materials, says Mr. Salminen from Kemira OYJ

Key Points

- 40% of the plastic waste comes from packaging, and a lot of that waste goes into the environment, of which only 9% is recycled.

- Transforming Industries: How Chemistry and Fiber-Based Materials Are Shaping a Sustainable Future

The Pulp and Paper Times:

Mr Antti Salminen, President- Paper Segment, Kemira OYJ, Finland shares his views about the role of chemistry in pulp and paper industry and shares how chemistry plays a crucial role in making a sustainability transformation of the world. He shares how chemistry can help world get out of plastic and replace it with sustainable, recyclable fiber-based materials.

Sharing his views on the role of chemistry in the paper industry during Paperex 23, Mr. Antti Salminen, said, "The sustainability transformation is not only of the industry but of the world. Many people have already addressed the key points about its role in making this world a sustainable place. I will talk about chemistry because chemistry is needed when converting wood-based fiber into different applications that we need today or in the future."

He added, "The world needs to reduce its dependency on oil. This transformation will take time and will require technical developments in different areas of the industries. Consumers, regulators, and brand owners are pressuring industries to decrease their dependency on fossil fuels. The pulp and paper industry will play a crucial role in this transformation."

He added further, "We have solutions for its problems. Wood-based fiber and cellulosic fiber are at the heart of this transformation. The fiber is circular, renewable, recyclable, and biodegradable, so it ticks all the boxes. It can minimize the environmental impact of the packaging solutions. We need to take care of sustainable forestry and farming, while making sure that we have the right balance. If correctly managed, it will reduce the world's reliance on finite oil-based resources. It is safe and versatile, and with technology and chemistry, it can modify wood-based fiber in thousands of applications, which is why I see that the future is bright. Globally, we are facing one of the steepest downturns in the industry. It maybe not visible here in India; last year the demand fell in the industry. But this is short-term. It's a cyclical industry, and in the long term, fiber will be key for global economy."

"It all starts with packaging, which we all know so well. It was maybe the first reinvention of the industry, moving away from the paper industry into packaging. The e-commerce industry has been driving growth for the past few decades and developing the right kind of solutions for lightweight, durable packaging for global industries, be it investment goods or consumer goods. Still, 40% of the plastic waste comes from packaging, and a lot of that waste goes into the environment, of which only 9% is recycled. Plastic is a fantastic solution for several applications; it's cheap and lightweight, but not sustainable, and we need to come up with alternatives. There's regulatory push in many parts of the world, there is a big brand pull. Many global brands, packaged food producers, textile companies are pushing politicians and regulators, for more circular, biodegradable, and sustainable packaging solutions," he added.

Talking about liquid packaging, he said, "One of the problems that the industry needs to solve is barrier coating for liquid packaging. For example, a fiber-based coffee cup, however, to hold liquid, there is still a polyethylene coating or barrier inside. The same goes for liquid packaging, which decreases the recyclability of the fiber-based material. So, we need solutions for creating barrier properties without using polyethylene or oil-based materials. And there, we and other chemical companies can help by coming together with the board producers and other technology providers to come up with solutions that will be biodegradable, but that's one of the challenges still ahead of us."

Another area that is growing is molded fiber or molded pulp solutions, and he added, "These technologies have been there for a long time; they've been relatively low-tech and used for low-tech applications, but now we've seen that the consumer goods industry is moving towards replacing plastic-based package materials with molded fiber-based materials. Much of the stuffing in the cardboard box is not plastic or bubble wrap anymore; it is molded fiber because it's lightweight, durable, and can be used in different applications. And again, to enable these high-end solutions for molded fiber, technological development is needed, both in terms of machines and chemistry."

Talking about textile industry, he said, “The industry is fiber-based and has many similarities to the pulp and paper industry. There are two sources of raw materials: oil derivatives, i.e., synthetic fibers or cotton, and natural fibers, and neither, as an industry, are sustainable. Paperboards are recycled, but only around 1% of all textile fibers are recycled. Similar technologies are required to recycle both. We need to de-ink them, repulp them, and then give the fiber new properties as every cycle it gets weaker and weaker, so there's a lot of the knowledge that we have will be in demand in the textile industry. Many new startups are working on producing textile fibers out of the wood. Not only existing technologies but new technologies are coming, and we should not give this opportunity to the traditional textile players, as the pulp and paper industry possesses the expertise."

“Chemistry needs to support these sustainability shifts in the industry. To change the properties of the fiber, you need different chemicals, as we are using in the pulp and paper industry. Right from the pulping, bleaching, and deformers, and going into strength chemistry, all that is needed and more when we get to these new applications. But what's more important is that we are using many oil-based chemicals in terms of the feedstock. So we, as a chemical industry supporting the paper industry, need to get out of fossil fuels and come up with innovations with sustainable chemistry,” he added.

He stated, "We aim to make our chemistry as sustainable and renewable as our base product - the fiber. By 2030, we have set a target of generating over half a billion euros in revenue from renewable chemistry, which will only increase from there. Achieving this goal requires extensive research, development, and trials with our customers - the pulp and paper, and board producers. We acknowledge that our competitors will also introduce new chemistry, but we are confident that we will lead the way in making the industry more sustainable and renewable."

He opined, “However, sustainability is not enough, as many uses for fiber-based products require properties that we have not imagined. For instance, the functionality of the chemistry also needs to change. So we all need to work together to be able to develop products with new properties. It is not out of the question that one day when you buy a new car, the dashboard, instead of plastic, will be a wood-based composite. To produce that composite, you need different value chain technology and machinery than the traditional board-making ones. You need chemistry to get these properties, but we need to understand that as the division of the industry, our job is not to produce paper; our job is to help this world get out of plastic and replace it with sustainable, recyclable fiber-based materials.”

AFRY's David Powlson unveils promising future for India's paper sector amid global dynamics

Paperex 2023 unveils futuristic approach to paper industry: eminent speakers illuminate the path ahead. join the panel discussion on the decade ahead with industry visionaries. don't miss expert insights on the future of paper – here's a glimpse of our distinguished speakers and their addresses!

Mr David Powlson, Director, AFRY, the global engineering and design company, a groundbreaking outlook on the future of India's paper sector has emerged. After an extensive forecasting process spanning the next seven to eight years, Powlson reveals a robust view of the industry, emphasizing India's pivotal role in shaping the landscape of global paper demand.

The Pulp and Paper Times:

Unveiling the Global Paper Market Landscape

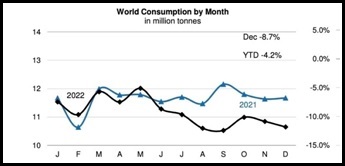

According to Powlson, the paper sector is experiencing varied trajectories worldwide. On a global scale, the industry is witnessing a 1% per annum growth, with nuances across different paper grades and geographical locations. Newsprint is facing a marginal decline, graphics paper is experiencing modest growth, while tissue emerges as a significant player, displaying substantial growth rates. However, it is packaging that takes the spotlight, contributing significantly to the overall growth volumes.

India: A Beacon of Growth

In this dynamic scenario, India emerges as the standout player, predicted to showcase the highest levels of growth globally. Despite newsprint facing a flat to marginal decline and graphics sector growth slowing down, the Indian paper market is set to soar. Tissue, in particular, is expected to witness an astounding 9% annual growth over the next seven to eight years, driven by a low consumption level that magnifies the growth impact. Additionally, packaging is projected to experience growth rates well above 5-6%, further solidifying India's position as a major contributor to the paper industry's expansion.

Factors Fueling India's Ascendancy

Several factors contribute to India's promising outlook, including its impressive GDP growth - the highest in the world at present. Population growth, environmental considerations, and sustainability concerns also play pivotal roles in propelling India forward in the paper sector. Paulson underscores the connection between GDP growth and paper demand growth, highlighting India's exceptional economic performance.

Challenges and Opportunities

While acknowledging past infrastructure challenges that hindered production growth, Paulson remains optimistic about India's future trajectory. He notes that the industry is poised for positive developments, driven by an overall growing economy, robust environmental policies, and a population that continues to expand.

In conclusion, AFRY's forecasting paints a vibrant picture of India's paper sector, presenting a compelling narrative of growth, sustainability, and economic vitality. As the nation solidifies its position as a key player in the global paper market, the world watches with anticipation as India's paper industry journeys toward a promising and prosperous future.

Satia Industries has a strong order book covering more than one month of revenues, despite a decline in revenues due to softness in pricing in FY24

Key Highlights:

- Company’s healthy order book and lower raw material prices have helped the company in improving the gross margins at 57.1% in FY24 as compared to 52.7% in FY23. For Q4FY24, gross margins were 56.0%.

- Net profit stood at INR 2,112 Mn in FY24, up 10%.

- Satia Industries successfully completed the commissioning of 75 TPH multi fuel boiler.

- SIL has a strong order book covering more than one month of sales.The Pulp and Paper Times | 28 May 2024

Satia Industries Limited (SIL), is one of the largest Wood and Agro-based paper manufacturer in India. It surprisingly overtook many of its peers in production achieve, to 2,13,804 MT in FY24 implying a capacity utilization of 98%. SIL has successfully commissioned their PM 4 and has augmented its total installed capacity to 219,000 MTPA.

Marked by the industry headwinds w.r.t. to softness in pricing and challenging demand environment, the company saw a 9% decline in revenues to INR 17,208 Mn in FY24. For Q4FY24, the revenues were INR 4,306 Mn.

Commenting on the financial results for FY 23-24 and Q4, Executive Director Mr. Chirag Satia, said, “FY24 demonstrated our resilience. Despite facing industry headwinds, we are pleased to have improved our profitability this year. This success was driven by our strong relationships with state textbook boards and our stringent expense control. For FY24, our revenues were INR 17,208 Mn. Although this represents a decline due to lower paper prices, it is noteworthy that our volumes remained steady. Currently, we have a strong order book covering more than one month of revenues. These orders provide a buffer against adverse industry impacts.

During Q4 FY24, we observed a decline in both paper and raw material prices. Notably, the prices of wheat straw and agro pulp dropped significantly, positively impacting our profitability this quarter. We capitalized on this by increasing the use of agro pulp, further enhancing our savings and margins. While wood pulp prices rose, our existing inventory cushioned the impact on this quarter's performance.

He further said, Satia Industries remains steadfast in its commitment to enhancing operational efficiencies and optimizing resource utilization. Our focus on continuous improvement across projects enables us to effectively address challenges. We are pleased to announce the successful commissioning of our 75 TPH muilti fuel boiler.

Looking ahead, we are well positioned to leverage our synergies from our strategic initiatives and remain confident in our ability to navigate any external industry challenges. Our commitment to delivering shareholder value remains steadfast, achieved through stable revenue streams, strategic cost management, and targeted investments. We maintain optimism about the future despite current market conditions and are confident our focused efforts will propel us on a positive trajectory.”

ITC's Paperboards and Specialty Papers Division (ITC-PSPD) has disclosed its financial results for the fourth quarter of FY24, revealing a 6.7% year-on-year decline in revenue, totaling INR 2073 Crore. The company attributes this downturn to competitive pressures from low-priced Chinese supplies in global markets, muted domestic demand, and surge in wood costs.

Global and Domestic Challenges: In its submission to the Securities and Exchange Board of India (SEBI), the company highlighted the subdued global demand and a slowdown in domestic demand . Paperboards, Paper and Packaging Segment remains impacted by low priced Chinese supplies in international markets (including India), muted domestic demand, surge in wood cost and high base effect. Demand environment remains subdued across domestic and global markets.

The report stated that subdued realisations and surge in domestic wood prices exerted pressure on margins; structural advantages of an integrated business model, Industry 4.0 initiatives, strategic investments in High Pressure Recovery Boiler and proactive capacity augmentation in Value Added Paperboards aided in partly mitigating pressure on margins. Despite the headwinds as aforestated, the Business further strengthened its leadership position in the Value-Added Paperboard (VAP) segment through focused innovations, development of customised solutions for end-use industries and strong end user engagements.

During the year, the Company’s wholly owned subsidiary, ITC Fibre Innovations Limited, commissioned a state-of-the-art premium Moulded Fibre Products manufacturing facility in Badiyakhedi, Madhya Pradesh, to foray into the fast growing premium Moulded Fibre Products (MFP) space with applications across industries including food serving and delivery, pharmaceutical, beauty and electronics.

Capacity utilisation of Nadiad packaging and printing unit in Gujarat progressively ramped up.The state-of-the-art premium Moulded Fibre Products manufacturing facility commissioned in Mar’24.

“The Paperboards, Paper & Packaging Segment had to contend with soft domestic and export demand conditions which significantly depressed net realisations, cheap Chinese supplies in international markets including India, unprecedented escalation in domestic wood costs and high base effect.” The report outlined.

“Paper based sustainable alternatives designed to replace single-use plastics continue to be ramped up with ‘Filo’ series - ‘FiloBev’ (for cups), ‘FiloServe’ (for QSR, bakeries, food retail) & ‘FiloPack’ (packaging for sweets and deep freeze applications), witnessing strong growth momentum in both domestic and international markets. During the year, Flustix (No Plastic) certification also has been received for FiloPack. The Business is stepping up investments, in this fast-evolving space which holds immense growth potential, supported by the R&D capabilities of the Company’s Life Sciences & Technology Centre, and external collaborations with global specialists. The Business continues to focus on developing and scaling up several innovative solutions towards “Reducing, Reusing and Recycling” of plastics; these are under various stages of commercialization” the report said.

A pipeline of products developed through proprietary solutions such 10 as ‘Bioseal’ (compostable coating to replace plastics), ‘Oxyblock’ (recyclable coating solution to enhance barrier properties in packaging) and ‘Germ free coating’ (solution for microbial free packaging surface addressing the consumer consciousness towards hygiene and safety) have been introduced, with increasing adoption levels across end use segments.

Education and Stationery Products:

The Education and Stationery Products industry witnessed strong growth during the year driven by increased household penetration on the back of higher enrolment ratios and growing literacy. The year also witnessed heightened competitive intensity with a resurgence of regional players on the back of moderation in input prices. During the year, the Business consolidated its leadership position in the industry, driven by innovative product launches and portfolio premiumisation.

The ‘Classmate Interaktiv’ Notebook portfolio continued to witness strong consumer traction driven by a wide range of differentiated offerings. These included products that enable ‘Do It Yourself’ activities with a view to ‘Enjoy Learning’, immersive technologies such as augmented reality and interchangeable covers. The Business also accelerated the adoption of ‘Classmate Pulse’ spiral format through targeted activations and focusing on new customer segments such as high school students, in addition to college goers and the youth segment. The ‘Paperkraft’ portfolio was also strengthened with the launch of a new range of notebooks with differentiated design themes catering to both personal and professional usage. The Writing Instruments portfolio delivered a strong performance on the back of recent launches with differentiated forms and features which received encouraging consumer response.

The Business sustained its leadership position on e-Commerce platforms through consistent availability of a wide assortment of products, backed by focused interventions to enhance consumer traction.

During the year, the Business enhanced its manufacturing capacity of spiral notebooks at its dedicated manufacturing facility at Vijayawada. Equipped with state-of-the-art technology, the facility enables the Business to develop differentiated notebook formats, drive cost reduction and address opportunities in overseas markets.

Packaging and Printing Business:

Packaging and Printing Business continues to be acknowledged as a ‘first choice packaging partner’ by several reputed FMCG companies in the country for providing superior and cost-effective packaging solutions incorporating high quality structural design, print embellishments, enhanced security features and design–for–recyclability. During the year under review, the packaging and printing industry witnessed several headwinds. Subdued demand in certain key end user industry segments, progressive de-cartonisation in the liquor industry and decline in price realisations rendered the operating environment extremely challenging. The recent capacity addition at Nadiad, Gujarat, with state-of-the-art equipment to cater to markets in Western region, has further augmented the Business’ capabilities in Carton packaging. Capacity utilisation at the facility has been progressively ramped up during the year.

APRIL Group enters India's growing Tissue market by acquiring Origami, bolsters global expansion strategy

The Origami Acquisition Marks APRIL’s Entrance Into India’s Fast-Growing Tissue and Personal Hygiene Market

The Pulp and Paper Times | Singapore, 15 May 2024

APRIL Group, a leading global producer of fibre, pulp and paper, has acquired a controlling stake in Origami, India’s leading consumer tissue products company, marking its entrance into the fast-growing India tissue and personal hygiene market. APRIL Group is a member of the Singapore-headquartered RGE group of companies.

Origami, a household name in India, is a fully integrated operation spanning tissue paper mills and converting plants operating at multiple locations and distribution centers across the country. As India’s leader in tissue and personal hygiene, Origami manufactures an extensive product range covering facial tissues, paper napkins, toilet tissue rolls, kitchen towels, hand towels, and wet wipes under the Origami and affiliated brands.

Origami was founded in 1995 by Neelam and Manoj Pachisia, who will continue to hold a significant minority stake in the company and continue to lead the business following the completion of the acquisition.

The Indian tissue market has shown significant year-on-year growth, driven on the back of India’s fast evolving middle class, consumer perceptions and habits on hygiene and personal care. This has created a market environment in which international-standard personal hygiene products are increasing in demand, with headroom to grow given that per capita consumption is well behind global standards.”

“The Indian tissue market is rapidly expanding, driven by consumers’ evolving perceptions and habits on hygiene and personal care,” said Suneel Kulkarni, Country Head, APRIL India & Subcontinent.

“By bringing together APRIL and Origami, we’re well placed to serve the growing national demand for high quality, sustainable personal hygiene products.”

APRIL has been a leading exporter of pulp and paper products into India over the last 25 years. The acquisition of the controlling stake of Origami is part of APRIL’s strategy to expand its global footprint into the world’s most populous markets following recent investments into the tissue markets in China, Southeast Asia and Brazil. In India, APRIL plans to follow its successful model to integrate leading local enterprises into its global growth plans and provide the resources to upgrade technology and processes to provide world class environmental conscious products at affordable prices.

Leveraging the company’s status as a leading supplier of pulp to India, APRIL’s acquisition of the controlling stake in Origami also enables the group to ‘Make in India’ to further support foreign direct investment in local production.

“Together, APRIL and Origami are stronger,” Mr. Kulkarni added. “With this acquisition, APRIL is well-positioned to drive increasing penetration and access to high quality and sustainably produced tissue paper and other products to the Indian consumer. This growth will be achieved through additional investments across manufacturing, deepening existing channels, expanding and developing new channels, and product innovation.”

Indian paper industry sees price increase due to rising raw material costs

The Pulp and Paper Times | May 8, 2024Virgin grades paper prices are seeing a correction due to the significant increase in the costs of raw materials, transportation, and other essential inputs required for operations, affecting the paper price dynamics of the Indian paper industry. Hardwood pulp and waste paper prices have surged significantly. Continuous increases in the cost of raw materials and freight have initiated this price increase to cover the cost.

There have been price hike circulars issued by JK Paper, APP, Bindal Papers, and Khanna Paper. The increase looks significant, ranging from Rs 1,000-2,000 a tonne for various virgin grades, including boards.

View Latest Jobs from Paper and Allied Industries : Join Now

JK Paper's letter to its Channel Partners & Customers stated, "In recent months, we have faced a significant increase in the costs of raw materials (Wood & Pulp), transportation, and other essential inputs required for our operations. Despite our efforts to absorb these rising expenses, we find it necessary to adjust our prices accordingly."

“Due to continuous increases in the cost of raw materials and freight, it has become necessary to initiate this price increase to cover the cost,” APP (CHINA) informed its valued customers.

Effective 16th May 2024, JK Paper announced an increase in the prices of its products. New Prices will be applicable for all fresh orders received from 16th May 2024 as mentioned below. This adjustment is essential to sustain our business operations due to the rising input costs. New Prices will be applicable for all fresh orders received from 16th May 2024. JK Paper increased the price of all FBB Grades (JK Tuffcote family) by Rs. 2000/- PMT, FBU SS (Uncoated Board) by Rs. 2000/- PMT and all Polycoated Grades -by Rs. 2000/- PMT.

“The Price of HW Pulp has gone up by 25% in the last couple of months. Also, the Recovered Paper has witnessed a 15% increase in the last 1 month. And so, we have decided to initiate this Price Increase,” Khanna Paper said in its intimation to its channel partners and Customers.

APP (China) is announcing a minimum price increment of 20 USD/t effective from May 15th, 2024. Khanna Paper Mills is increasing the Price of W&P Grades by Rs. 2000 PMT w.e.f., 7th May'24.

Bindals Papers Mills said in its intimation that Considering the sharp escalation of Raw Material prices and pressure on production cost, we are increasing the price of our Writing and Printing Grades by Rs. 1000/MT with immediate effect i.e. from 06th May'24.

“Large Mills are converting their machines into brown paper, people are tending to use more recycled paper than virgin paper,” says Mr. Inder Aurora of Tradecom International

- Prices go up and down depending on whether China is in the market or not

- All the big mills in India are setting up their own pulp lines to make their own BCTMP hardwood

- We would want to trade more within Southeast Asia, so that's why we have a zero-import dutyIn an exclusive interview with The Pulp and Paper Times during Paperex 2023 in December, Mr. Inder Aurora, Managing Director, Tradecom International Pvt. Ltd. shares his thoughts on several topics, including quick review of the present recovered paper trade , import of paper, pulp market, sustainability in the raw material supply chain. Here is the whole interview he gave.

Q: please share a small introduction of Tradecom International

Tradecom International was started in 1988. It's been over three decades now, so we deal in recovered papers and wood pulp, and our customer base is small and medium mills in terms of imported recovered paper and wood pulp. Our customer bases are all large integrated pulp and paper mills, and on the unit side of the business, we have a couple of verticals. We are wholesale dealers for ITC as well as running converting centers for ITC, and we also import liner boards and high-quality flutings and customize them at two locations, one in Pune and one in Sonipat, and supply them to all the converters on a pan-India basis.

Q: Being a reputed importer of recovered paper, how do you analyze the waste paper market?

I can only say that there has to be growth in India in the paper industry. The major raw material will continue to be recovered paper, whether it is imported or domestic. Domestic collections and infrastructure will eventually improve, so we will be able to utilize more and more of the waste we generate within the country and import it to countries like America and the UK that have surplus waste paper that they will continue to ship to India because India is now the largest market. Even though China has banned recovered paper, they continue to buy large volumes via their operations in Southeast Asia in terms of recycling pulp.

I must mention here that there has been a big announcement by ITC: they are putting up an INR 4,000 crore investment in Uttarakhand to come up with the integrated pulp and paper mill, so this is one of the major expansions that we have seen recently in terms of integrated pulp and paper mills, but having said that, the majority of the requirements of India would be fed with imported and domestic waste paper.

Q: India consumes large quantity of imported waste paper. There are new large capacities coming up in the Europe and America and they will also consume waste paper. Will it be difficult for Indian Paper mills to get the raw material at a lower price? how do you see that this situation?

Let me put it this way: globally, pulp and paper production is over 400 million tons, and on average, there is a 5-7% growth in terms of production and consumption. Also, that will finally relate to the generation of waste paper, and China is indirectly importing by setting up mills across the world to make recycled pulp and send it to their plants in their home country, and China has been a major player not now but from day one. In fact, when they stopped importing waste paper, they were a 50% net importer of waste paper from all over the world, and now slowly, by setting up these mills, they will scale up to their 50% recycle pulp thing, but the rest of the 50% is available for the other countries, and India, also being a major pulp and paper industry, is growing very well.

I think there should not be any challenge in getting volumes of what we want, and our domestic collection is very low at the moment in terms of what you see in Germany and Japan, which is touching about 70 to 80%. Mills who are making paper from virgin pulp or they're importing market pulp, so that waste also eventually gets into the stream and is available for the mills for recycling, so I don't see much challenge.

Q: There's a severe fluctuation in the waste paper prices. How a paper mill can ensure the sustainability in its supply for the imported recovered fibre with the lower price ?

Prices are something that is 100% based on market demand and supply. We have seen lately the volatility on two accounts. Let's say when we talk about waste paper prices in the USA, we have seen a lot of large mills or groups like Cascades and Domtar converting their machines into brown paper, producing test liners and flutings, so there's a lot of demand from those mills. These are large mills that have been converted, and also from the point of view of sustainability, people are tending to use more recycled paper than virgin paper, so obviously there has been good demand within the country, which has driven this price to be on the higher side, but if somebody wants to import at this price, waste paper is available.

The cost of any waste paper being imported into the country, there is I would say 60 to 70% fiber and 30% shipping cost so shipping has been a very down after the Covid, this so something of the compensate to the net CIA prices.

Q: There are new capacities in Pulp generation coming in overseas market; we might see the dumping of pulp in to Indian market at lower price. Do you think that it will hamper the profitability of Indian paper mills?

I don't hear much major expansion in the pulp segment across Asia; in fact, major producers in Asia like APP and April are putting machines after machines; they're also expanding in the tissue segment very aggressively, and they're trying to consume all their pulp. The only thing is that the availability of pulp from these mills to the market is not there as much. I don't see major expansions there. India will have to when they have to import market pulp. Most of the mills, which have their own integrated operations, are also facing challenges with wood prices. This volatility in pulp has also been there laterally. We saw hardwood pulp prices going sub-$500, and now we are talking about $600+. Now, China’s economy is pretty closed in terms of various growth elements. Once they wake up, there's probably going to be huge demand from China. Once China stops buying paper, prices go down, so I feel this challenge of volatility in prices, be it waste paper, pulp, or paper, is going to be there, and we have to get used to it.

Q: Imported pulp is a one of the raw material for paper mills, what appreciation do you project in the demand of imported pulp in next 5 years? Also do you think that tableware manufactures could be the new consumer of the imported pulp in future?

I am not very knowledgeable about this, so I can't say much, but I can say that the mills that don't have enough pulp capacity compared to their machine capacity are the main users of market pulp. On the other hand, non-wood paper mills require a specific percentage of long fiber to supplement their furnish. Most large paper mills are primarily covered by their own pulp operations. Thus, there hasn't been a significant growth. We do hear about Satia Industries expanding a machine and other things, but that hasn't really altered the dynamics of pulp demand in India. BCTMP pulps are the only area where there is a significant need for pulp that has grown over time.

A lot of mills are coming into BCTMP pulp, and there has been a greater demand for all the pulps in BCTMP. BCTMP soft food has to be imported, but all the big mills in India are setting up their own pulp lines to make their own BCTMP hardwood, but then softwood has to come from North America or Scandinavia. So, demand in Europe and China or within North America has not grown as much, so this pulp is available to all these mills, but again, prices go up and down depending on whether China is in the market or not.

Q: As claimed by some paper mill association, that excess import of paper is hampering the small & medium Paper mills viability; How would you define this situation?

I don't want to comment on anything that will lead to a controversial discussion, but I think the open economy is always better than a protected economy. It gives a chance to improve your operations, and that eventually leads to longevity in the business. If you are in a protected environment, in a sense, you're not exposed to the international situation, and eventually you will get exposed regardless of how much you protect your economy. So I can only comment that I'm from a school where I would vote for an open economy, but I would not get into deeper details about whether there should be anti-dumping duty or not.

Q: Don’t you think that there has to be a level playing field for importer and paper mill; import of paper should be at a benchmark price in order to prevailing healthy market competition. Your comment please.

Anybody can have a different perspective, so today we are signing up ‘N’ number of FTAs (free trade agreements) with different countries around the world to increase trade between us, and then, as an ASIAN region, we want this region to develop to be known as Europe of Asia or North America of Asia. We would want to trade more within Southeast Asia, so that's why we have a zero import duty. Today we are seeing mergers of industry across the world, like, in a sense, recently, Smurfit Kappa and Westrock are merging, so this will create a giant, but at the same time, it will also give room for other players to expand. Today they used to compete and whatever the end result of all that competition was, but now they're going to work together and they're going to play with the market, but at the same time, there are other groups also around the world, so they will have a strategy to put in place, so that doesn't mean that this will lead to something bad.

Andhra Paper declares a lockout at the manufacturing plant of its Rajahmundry Unit due to an illegal strike, resulting in losses of INR 1.95 Cr per day

East Godavari, Andhra Pradesh | 25 April 2024 | The Pulp and Paper Times:

In a recent development, the Board of Directors of Andhra Paper Limited (APL), a prominent player in the paper and pulp industry, has decided to declare a lockout w.e.f. April 24, 2024 at 3.00 P.M. at the Rajahmundry Unit and it shall continue till further notice in this regard.

In a letter submitted to BSE by Andhra Papers said, that operations of the Manufacturing plant situated at Unit: Rajahmundry had been disrupted due to illegal strike of the workers called by the Workers Trade Unions w.e.f. April 2, 2024.

The Management said, that due to their continued illegal strike and unlawful activities of stoppage of work and considering the prevailing situation and keeping in mind the safety of employees, plant and machinery, materials and other assets, the Management has decided to declare a lockout w.e.f. today i.e., April 24, 2024 at 3.00 P.M. at the said Unit and it shall continue till further notice in this regard.

“The reasons for Lockout is illegal strike with unreasonable demands and Non co-operation of workmen to resume manufacturing operations” the letter said

The Management said the due to this strike APL is bearing loss of production per day approximately, INR 160 lacs per day (total , 195 lacs per day for the Company as a whole)

"The Management under the prevailing conditions & continued stoppage of plant operations, hereby declare Lock-out in the Mills w.e.f. 24.04.2024 from B-Shift i.e., 03.00 PM onwards excepting the essential services and support / allied services (as per the list at Annexure-II) and also Works Office, Industrial Relations, Welfare i.e., Township Maintenance & Sanitation, Transport, Sewerage Treatment Plant, OHC Medical Centre and Security & Fire Fighting departments", a notice stated.

Earlier, In a letter to SEBI, APL said, In continuation of the intimation vide our letter dated April 3, 2024 we would like to inform you that, the operations of the Manufacturing plant situated at Kadiyam Unit, East Godavari has been temporarily shut down on April 15, 2024 owing to non-availability of pulp from manufacturing unit at Rajahmundry where the illegal strike by workmen called by the workers unions is continuing since April 2, 2024. The Kadiyam unit will resume operations as soon the pulp supply is restored.

Management has appealed the striking workmen to call off and resume the duties and to restore the normalcy for further negotiations/discussions. Defying the management appeal continuing the illegal strike is accumulating the operational business losses which will impact on the Company's survival. It is also noted that the striking workmen abetting and intimidating the staff & other loyal workmen who are attending their duties.Kadiyam unit is dependent on Pulp Supply from Rajahmundry Unit where Pulp production stopped due to ongoing strike since April 2, 2024.

Mohit Paper Mills gives unexpected return and growth in sales and profits; decides to install Boiler and Evaporator to increase the capacity

- The Company has turnover (Net) of Rs. 22,216.5/- (In lakhs) as against previous figure of Rs. 14,079.85/- (In lakhs), the Company recorded increase in sale 57.79% (approx) in FY 22-23

- The management decided to install 150 TDS Boiler and Evaporator (“BE”) in the production line, the purpose to install this BE to increase the production with existing production capacityThe Pulp and Paper Times:

Mohit Paper Mills Limited is engaged in manufacturing of various kinds of paper like Writing Printing Paper (colour and white), MG Poster paper, kraft paper and others various quality papers as required on customer demand. MPML is agro based Company using agro product for manufacturing the final product i.e. paper like Bagasse and other agriculture waste product which are abundantly available in the vicinity of the manufacturing unit.

the last previous financial year Mohit Paper has sustainable growth in term of sale as well as in term of profit, The total revenue was INR 222 coror (approx) which is compare to 140 crore rupees (approx) in last year, which is recorded growth 57 % (approx) where as growth in term of term of income MPML has recorded INR 4 crore (approx) profit as compare to INR 1.98 crore (approx) in earlier year, so that profit growth is 150% (approx), growth in the profit, with respect to the projection of 24 months.

MPML’s annual report stated that company is on expansion mode and setting up new recovery boiler in premises by installation of that recovery boiler production cost will be lower down simultaneously adding the additional stem. By making installing this boiler the profitability of the company will be increase by reduction of the cost.

At present the production capacity of the Mohit Paper is 130 MT/per day and the Company always try to utilised it’s maximum production capacity. In the financial year 2022-2023 the management decided to install 150 TDS Boiler and Evaporator (“BE”) in the production line, the purpose to install this BE to increase the production with existing production capacity. The idea behind to install BE is that to increase the production of steam, power and caustic soda lye and result of this increment in steam, power and caustic soda, the production will be increased within the existing production capacity. After installing the BE, the Company can utilized its optimum or maximum production capacity.

The management of the Mohit Paper always keeps keen eyes on every transitions of the Company. MPML is moving fast to maximization the wealth of shareholders and stakeholders. In paper industry MPML is regularly exploring and critically appraising its domestic market, the company saw downfall in respect of revenue and other aspect in the last year ( FY 21-22) due to stiff competition in the market. The Company has maintained good standards in its products and always be trying to give sharpness to the Company’s marketing strategies

At present new machines come with various facilities helping to improve the efficiency and financial viability of mill. Your Company is always in search of such opportunities and is in the process of increasing its capacity and quality improvement. In the near future the Company is in the process of increasing its capacity.

Segment or product wise Performance:

During the year FY 22-23 Mohit Paper has achieved the good level of capacity utilization with respect to the manufacture of the paper and it was done due to the expertise of the Managing Director, the technical staff and the hardwork of labourers. This is a good example of proper utilization of the capacity with minimum resources. The company is engaged in single segment of production i.e. manufacturing of paper, more than 98% of the turnover are depend paper segment. In relation of financial performance of the segment are: The Company has turnover (Net) of Rs. 22,216.5/- (In lakhs) as against previous figure of Rs. 14,079.85/- (In lakhs), the Company recorded increase in sale 57.79% (approx).

During the financial year 2022-2023, the Company gives unexpected return and growth in sales and profits. The Company has recorded immense growth during the year under review. The Company has turnover (Net) of Rs. 22,216.5/- (In lakhs) as against previous figure of Rs. 14,079.85/- (In lakhs), the Company recorded increase in sale 57.79% (approx) further the Company recorded other Income in the respective year of Rs. 411.03/- (In lakhs) as against previous figure of Rs. 185.79/- (In lakhs), the Company recorded increase in other income 121.23% (approx). As total income of current year is Rs. 22,627.53/- (In lakhs) and previous year was of Rs. 14,265.64/- (In lakhs), the Company recorded increment of 58.61%.

Net profit and PAT (Profit after Tax) was Rs. Rs. 491.56/- (In lakhs) as compared to previous year figure of Rs. 196.14/- (In lakhs) reporting an increase of 150.62% (approx) in net profit as compared to previous year

Future of Paper Industry

In current days paper is best option and demand of paper increased day by day, the demand of paper due to many reasons, which are:

Anti-Plastic thinking: There is either a reduction or elimination of the use of plastic in packaging. Antiplastic sentiment encourages biodegradable pulp and paper alternatives. This movement is being pushed forward by various government agencies as well as citizens who are concerned about their health. The problems caused by plastic present a wealth of opportunities for the paper and pulp manufacturing sector.

The rise in online market: In global markets are seeing an increase in the sale of products online day by day. It is anticipated that this pattern will carry on furtherance of years. Because of the proliferation of online shopping, packaging has had to develop to make the most efficient use of shelf space. There has been an increase in the demand for raw materials and corrugated boxes.

Food-packaging: The food packaging industry is undergoing change. Recently, there has been a rise in demand for packaging that is resistant to grease. This component can be found in a wide range of different packaged goods and restaurants and paper is used to packaging the food.

Archroma unveils groundbreaking PFAS-Free barrier coating for oil and grease applications

Pratteln, Switzerland, 19 March 2024 - Archroma, a global leader in specialty chemicals towards sustainable solutions, announces the launch of the latest innovation in their Cartaseal® portfolio, Cartaseal® OGB F10.

Cartaseal® OGB F10 is a superior water-based oil and grease resistant barrier coating that enables papermakers to provide high-quality and sustainable packaging by replacing fluoro based substances and polyethylene with a recyclable and repulpable coating. It is FDA and BfR compliant, making it suitable for the manufacturing of paper and board for food and non-food contact.

Key features and benefits of Cartaseal® OGB F10 include:

Superior oil and grease barrier: Offers unparalleled protection against oil and grease, ensuring the integrity and freshness of packaged goods. Its advanced formulation guarantees maximum resistance, providing peace of mind for both manufacturers and consumers.

Exceptional resistance even when folding: Provides superior oil and grease resistance (OGR) for folding box board and flexible paper packaging application, without compromising on performance.

Recyclable and repulpable: Facilitates easy recycling and repulping processes, contributing to a more sustainable packaging lifecycle. In addition, as it contains bio-based raw materials, Cartaseal® OGB F10 supports brands and papermakers in their journey towards sustainability by minimizing reliance on oil-based substances.

"We are excited to introduce Cartaseal® OGB F10 to the market, our latest barrier solution that addresses key challenges in the packaging industry while upholding our commitment to sustainability," said Sameer Singla, CEO PP&C at Archroma. "With its unmatched oil and grease resistance, exceptional foldability, and sustainability features, Cartaseal® OGB F10 represents a significant advancement in packaging technology, empowering businesses to meet evolving consumer demands while reducing their environmental footprint."

Cartaseal® OGB F10 sets a new standard for packaging excellence, offering a comprehensive solution that prioritizes functionality, sustainability, and performance.

Archroma remains committed to driving innovation and sustainability across the value chain, empowering businesses to embrace greener practices and meet evolving consumer demands.

Red Sea Crisis: Domestic players to build trust and listen to the customer rather than frequent price increases

- India’s imports of paper and paperboards are largely from South East Asian Countries and China

- The impact of Indian Paper Industry shall be very minimal as the pulp, mainly hardwood pulp comes mainly from Indonesia and South AmericaThe Pulp and Paper Times provides a brief analysis of the Red Sea Crisis and its implications for the paper sector. India is a significant importer and exporter of various paper goods, including pulp, finished paper, waste paper, and other types of paper. This crisis could have an effect on the market's price structure and put the sector in disarray. We conducted in-depth analyses of the Red Sea situation and spoke with a number of prominent figures in the paper sector. Here are the opinion of Mr Aseem Bordia, who is the Immediate Past President of the Federation of Paper Traders Association (FPTA) for the year 2022-2023. The views are personal

It is a fact that global supply chains could face severe disruption as a result of the world's biggest shipping companies diverting journeys away from the Red Sea. Attacks by Houthi rebels in Yemen on commercial vessels in recent weeks have resulted in many firms deciding to avoid one of the world's busiest shipping lanes. The Houthi group has declared its support for Hamas and has said it is targeting ships travelling to Israel, though it is not clear if all the ships that have been attacked were actually heading to Israel.

The group, which is backed by Iran, has been using drones and rockets against foreign-owned vessels transporting goods through the strait of Bab al-Mandab - a 20-mile-wide channel that splits Eritrea and Djibouti on the African side and Yemen on the Arabian Peninsula.

Ships usually take this route from the south to reach Egypt's Suez Canal further north. (Check above image)BBC news of December 26th,states that Danish shipping giant Maersk has said it is preparing to resume shipping operations through the Red Sea and Gulf of Aden. The move follows the deployment of an international military operation to prevent attacks on commercial ships by Yemen's Houthi rebels.German shipping firm Hapag-Lloyd has said it will decide on Wednesday, December 27th whether to resume using the route.

The Red Sea is one of the world's most important routes for oil and liquefied natural gas shipments, as well as for consumer goods.It is bookended by the Bab al-Mandab Strait - also known as the Gate of Tears - in the south near the coast of Yemen and the Suez Canal in the north.

The alternative route, around the Cape of Good Hope, adds about 3,500 nautical miles to the journey. This has led to fears of disruption to the supply of goods transported through the Suez Canal, and an increase in prices to cover the higher transport costs.

The news that shipping companies were avoiding the Red Sea route led the US to launch an international naval operation - named Operation Prosperity Guardian - to protect ships.

In a statement issued on Sunday the December 24th, Maersk said that with this initiative under way, "we are preparing to allow for vessels to resume transit through the Red Sea both eastbound and westbound"."We are currently working on plans for the first vessels to make the transit and for this to happen as soon as operationally possible."However, the world's second largest shipping company added that although security measures had been put in place, "the overall risk in the area is not eliminated at this stage". "Maersk will not hesitate to re-evaluate the situation and once again initiate diversion plans if we deem it necessary for the safety of our seafarers," it said.

Other shipping giants including Mediterranean Shipping Company (MSC), CMA CGM and Hapag-Lloyd have also been avoiding the Red Sea route because of the increased threat of attacks.