Waste paper & Coal imbalance makes finished paper prices unpredictable; may the Agro waste emerge as a solution?

Waste paper & Coal imbalance makes finished paper prices unpredictable; may the ‘Agro’ waste emerge as a solution?

-Imported Waste Paper price may touch to $400 per tonne in coming months, conversion cost of the paper mills increased across India by INR 3 to 5

- Agro waste-based paper mills are now making money in this tough time due to cheap raw material

- Time has come to invest in agro residue paper-making technology in order to reduce dependency on waste paper availability and save precious foreign exchange.

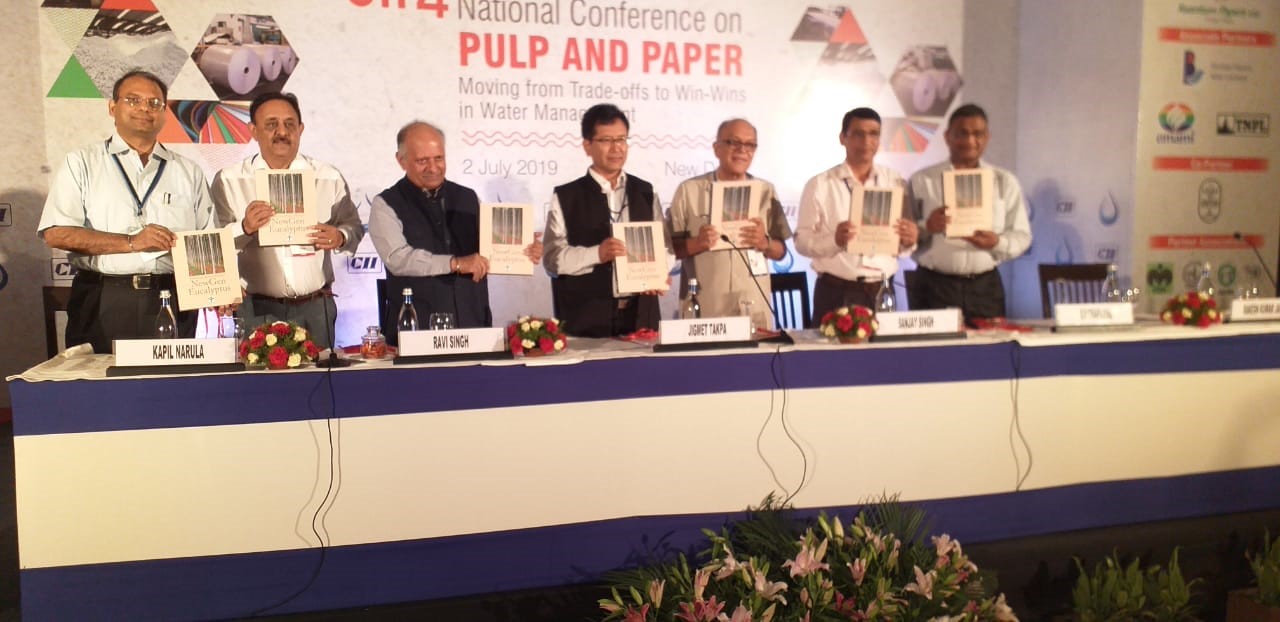

Delhi | UP | Punjab | Maharashtra | 27th October 2021 | The Pulp and Paper Times:

The rising cost on various fronts is diluting the profitability of Indian paper mills, The waste paper price hike, spike in logistic cost and now the coal price have made paper mills out of the business.

“The coal price has been increased by almost 70 percent in past few days which has triggered our production cost by INR 3000 per tonne. The dwindling market demand has resisted us passing on the hike to end consumers. The continued price momentum in diesel has also skyrocketed our transportation cost multi-fold,†said Mr. Vinod Agarwal, Director at Paswara Papers Limited situated in Northern India.

Talking in Indian Corrugated Case Manufacturers’ Association (ICCMA)’s Congress 2021 at Greater Noida, Mr. Arpit Bangur, Executive Director at Shree Packers (M.P.) Pvt. Ltd explained the coal crisis, and said, “ If you talk about cost structure in terms of energy then it’s pretty high. Almost 50 percent of conversion cost goes into power and coal. There are different kinds of paper mills i.e smaller medium size and higher capacity mills. Generally, those mills which are having a higher capacity of more than 200 TPD would be operating on their own power generation, so the coal consumption for these kinds of mills would be higher as compared to smaller mills. In terms of conversion cost, the impact of coal prices would be higher on middle mills because they are also generating their own power using coal. At the same time smaller mills may not have impact of coal because they are taking electricity from the grid and using biofuelâ€

“Waste paper crisis would likely to be more severe because lots of new capacities are coming up in Europe. Price of Imported OCC may touch to $400 per tonne in coming months,†said Mr. Vijay Mittal, Director at Nachiketa Paper situated in Punjab.

“I would like to add that of course, If paper mills are using coal completely for the entire energy requirement both electricity and steam, the impact is immediate. The moment price of coal go up the electricity and steam cost for a co-generating mills goes up immediately†said Mr. Manish Patel, Managing Director at The South India Paper Mills Limited during ICCMA’s Congress.

Western Uttar Pradesh big kraft paper mill, Nikita Papers Limited’s Managing Director, Mr. Ashok Bansal elaborates the current market situation for our readers, and says that coal shortage has increased our power and fuel cost by INR 2, and we are not in a position to pass on this hike in the market due to the fallen demand. On the waste paper side, the situation for paper mills will become worse after 10th November as European Union has proposed a ban on waste paper export due to a clerical error was made by The Indian Embassy in Brussels, which meant it accidentally banned recovered paper imports from the EU.

The European Union will now wait for confirmation in writing from the Indian Government and will then initiate a corrigendum process to correct the regulation.

Mr. Vinod Agarwal informed that imported OCC price is hovering above $330 per tonne which may go up if European Union bans waste paper export to India come in effect. Shipping lines have already enhanced their cost by almost 30 percent and demand for festivals has already been met.

Paswara Papers is now buying coal at INR 10500 per tonne which was coming at INR 6,500 per tonne earlier.

The FOB pricing of international coal, which is likely Indonesian coal along with African coal, went up from $30 per tonne to $155 per tonne. The price has gone up by five times.

Mr. Arpit informed that smaller mills are using 300 to 400 kg coal per tonne while bigger mills are using coal in between 800 to 900 kg per tonne for the drying process.

“Definitely, our conversion cost has also been impacted due to coal price, we are assuming that this whole price scenario of coal and waste paper prices should be corrected in next two months, currently, we are operating at 100 percent capacity but in coming time market factors may jostle our capacity utilization,†said Mr. Shankar Patel, Managing Director of Sukraft Group producing 1000 TPD kraft paper in India.

“Paper mills have to absorb all power cost triggered due to coal shortage, this trend is likely to remain till the end of year,†Mr. Agarwal said.

Mr. Ashok Bansal says that this accidental ban will suck production standards of paper mills also as we use to blend European OCC up to 30 to 40 percent with domestic waste paper for paper manufacturing. This ban will disrupt the psychology of the domestic waste paper market. We have to tighten the belt as the price of imported waste is bound to increase in the coming months.

Nikita Papers is now procuring Coal at INR 11000 per tonne which was earlier coming to their plant at INR 5000 per tonne, “we are assuming that downtrend in coal price should reflect after 15th November,†Mr. Bansal anticipates.

The coal impact has increased the conversion cost of the paper mills across India by INR 3 to 5 suddenly which is giving momentum to finished paper prices.

“Probably, paper mills may shoot up the price of finished paper by INR 5 per kg as I said 50 percent of conversion cost goes into energy and coal†Mr. Arpit anticipates.

Future is Agro waste:

“If this type of trend in waste paper price continues, Paper Mills need to think about an alternate ‘option’ of raw material for paper making. India is a farming country and there are plenty of agro residues which can be channelized towards paper making,†said Mr. Vijay Mittal, Director at Nachiketa Paper.

Paper mills using agro-waste in paper making are now earning money due to the lower price of agro residues in comparison to waste paper. “Paper made from agro-waste has better strength compared to paper made from waste paper, also it has better price realization from the market.†Mr. Mittal informed.

Time has come to invest in agro residue paper-making technology in order to reduce dependency on waste paper availability and save precious foreign exchange.

India being an agrarian country, agro residues such as Wheat straw, Rice straw, bagasse, Sarkanda are available in plenty yet the availability of straws and bagasse for paper making have dwindled over the past few years. The main reason for the non-availability of main agro residues for paper making is that the diversion of this for power generation or it continued to be burnt as in the past. We have established technology for paper making from straw and in the absence of adequate quantity of raw material available the production is hampering. The growth prospect of this industry is high. There is a need to propagate the concept of paper making from straw and discourage burning in the fields.

Agricultural residue like wheat straw, bagasse &sarkanda are basic raw material being used for paper making. First of all dry depithing is being done through duster drum to remove dust, sand and fines followed by wet washing to further remove the attached soil and sand etc in twin turbo washers and aqua separator.

Web Title: Waste paper Coal imbalance makes finished paper prices unpredictable may the Agro waste emerge as a solution?

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)