FPTA: Impose export duty on exports of paper; the process and system of PIMS are not transparent

FPTA: Impose export duty on exports of paper; the process and system of PIMS are not transparent

- PIMS would lead to creating unlevel playing field in favour of the large importers

- There is also no clarity on aqueous-based coating being used by some players to provide SUP alternatives

- The winds of recession are flowing all over the world

The below article is written by Mr Aseem Bordia, who has recently become the 61th president of the Federation of Paper Traders Association (FPTA) for the year 2022-2023. The views are personal; Mr. Bordia shares his views on export of paper, Waste paper scenario and the present state of the Indian Paper Industry exclusively with The Pulp and Paper Times.

October 2022 | The Pulp and Paper Times:

Paper Import Monitoring System (PIMS)

The PIMS has already come into play with effect from October 1st, 2022. The objectives are multi-fold:

i. To curb imports by traders.

ii. To keep a watch on imports from certain countries.

iii. To collect data on users, usage and quality parameters.

iv. To keep a watch on revenue.

However, the process and system are not transparent and will create more obstacles and hindrance for smaller players. It will add to the bureaucracy, rather than reducing the governmental interference. It would also lead to creating unlevel playing field in favour of the large importers and domestic manufacturers. The principle of ‘ease of doing business’ shall be negated. Finally, the data collected is likely to become open-source information, much to the disadvantage of the trade.

The trade in principle is not against the move, but have serious concerns and would like the government authorities to take all the stakeholders in confidence and review the same.

Price scenario of WPP and Packaging paper Current and Future (in next 3 to 4 months):

The geo-political and economical conditions remain unstable and uncertain. The winds of recession are flowing all over the world. There are too many external factors in play, which makes any gaze in the future very difficult.

Domestically, the prices seem to be under pressure. The demand has weakened and is not up to the expectations. The FMCG sector is facing headwinds and players have been forced to curtail production and reduce prices as well. Increased emphasis on digitization by the government, courts, and education sector has impacted the demand for WPP. Some of the sectors like wedding cards, and calendars and diaries have moved into the sunset sectors. There is too much happening on the ground. There are players who are under severe pressure and have reduced prices drastically. These are not small players. There are players who despite all odds are willing to move forward towards another price increase. Over all the scenario dark and cloudy with thunderstorms expected and one needs to carry an umbrella to protect himself.

Single-use plastic ban: demand growth prospects for paper, availability of paper to meet the extra demand:

There is a situation of confusion rather than clarity. Some of the states have announced but not implemented, some of them have notified and some of them are yet to announce and or implement. It is ‘each to his own’ situation. Further, there is no uniformity and clarity between the states who have implemented the provisions. There is also confusion about what has been banned and what has not been banned. There is also no clarity on aqueous based coating being used by some players to provide alternatives. There is also no clarity on the aqueous based coatings to have been approved by FSSAI and or FDA. There is also no clarity on the adhesives being used.

Certainly, some of the alternatives to the single use plastic would be paper based. Very conservatively there is enough domestic production available to meet the additional demand.

Export scenario of WPP and other packaging grade paper: Demand, Price Realization, benefit to domestic paper manufacturers, price pressure in the domestic market due to excessive export:

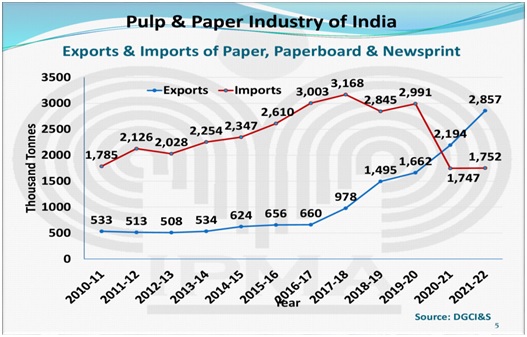

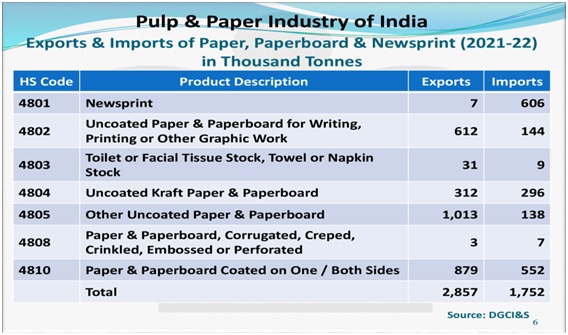

Post-pandemic the domestic paper industry in the FY2020-21 & 2021-22 has exported more than the imports. The chart below explains the above fact.

Source: IPMA

Source: IPMA

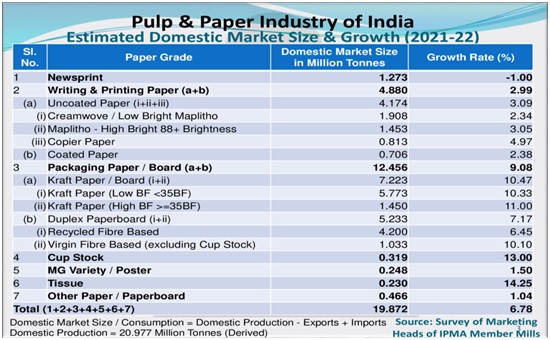

The domestic manufacturers in FY 2021-22 exported 14.377 percent of the domestic consumption and 13.619 per cent of the domestic production based on data of IPMA.

Source: IPMA

Source: IPMA

Significantly the exports were largely made by large mills using wood as their main raw material.

Source: IPMA

Source: IPMA

The weakening of Indian Rupee vis-à-vis US Dollar is likely to provide additional windfall realizations to the domestic manufacturers which is likely to be reflected in their Quarter 3 results of FY 2022-23. The exports still continue and as the exports are largely being made by large units the pressure on prices of products made by such units shall continue to persist. However, the Government of India should look to provide relief to the Indian consumers by imposing export duty on exports of paper and paperboard as has been done in the case of steel industry.

Waste Paper scenario (Demand and supply)

The waste paper scenario has eased as the availability has increased, the inward freight has come down substantially due to easing in the availability of containers and faster movement of ships, and southwards movement of prices of waste paper. This has proved extremely beneficial for the medium and small units as they produce nearly 72 to 80 per cent of the country’s production. In Rupee terms the imports of waste paper have increased from Indian Rupee 28.31 billion to 91.86 billion rupees in FY 2018-19, only to cross Rupees 110 billion rupees in FY 2021-22. This shows the dependence of domestic paper manufacturers on waste paper for fibre.

The Government of India should explore possibilities of setting up of Recovered Pulp making units from waste paper within the country and or at the waste paper exporting locations for 100 per cent import in the country. This measure will benefit the industry as well as the country.

Web Title: FPTA: Impose export duty on exports of paper; the process and system of PIMS are not transparent

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)