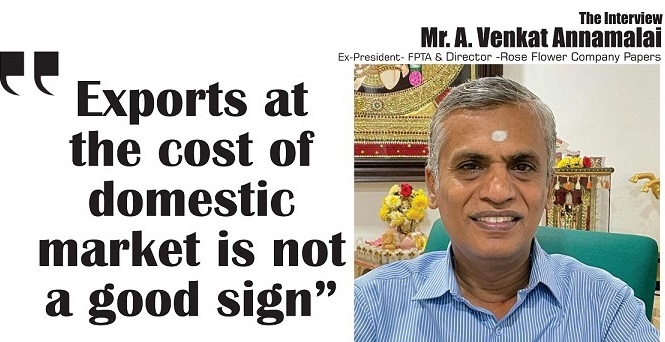

“Surging exports of paper will most certainly keep the domestic prices quite high”: Mr. A. Annamalai, Director – RFC

“Surging exports of paper will most certainly keep the domestic prices quite high”: Mr. A. Annamalai, Director – RFC

- Many Paper mills seem to have accepted fairly large orders from overseas markets.

- Domestic regulations are good enough to prevent any unfair practices by the big players.

June 2022 | The Pulp and Paper Times:

Recently, The Pulp and Paper Times got the opportunity to interact with Mr. A. Venkat Annamalai, Director- Rose flower Company Papers P Ltd and past president of Federation of Paper Traders’ Associations of India ( FPTA), over various issues related to paper trade, Import, Export, and growth of Indian paper industry. Here is his full interview:

Q: Please give us a brief introduction of Jeyam & Company and Rose Flower Company Papers Pvt Ltd (RFC)

Jeyam & Company is a 77-year-old family-held firm and we are the third generation in this business. We are one of the oldest Paper trading company in Tamil Nadu.

Our Associate Company “Rose Flower Company Papers P Ltd.,” was incorporated about 45 years ago for the purpose of exclusively handling the business of the Products manufactured by ITC Ltd., (Paperboard and Specialty Papers Division). We have been associated with ITC (PSPD) right from its inception as their Whole Sale Dealer.

Q: Being a past president of FPTA and active in Paper Trade for last four decades, what is your quick review of the present paper trade market scenario? About demand and supply dynamics of various grades of paper especially Coated, duplex, Newsprint, and Kraft paper segment.

I guess the current scenario is one of a kind which I have not experienced ever since I joined business ! I have heard from much more experienced elders that they have not experienced such a situation in their experience as well! We have witnessed an upswing of prices ranging from 30% to 70%. This ub normal sharp spike in prices was coupled with acute shortfall in supplies to the domestic markets due to the prior commitments made by the Industry to the Government sector as well as exports.

Demand and supply dynamics:

- Coated: prices have more or less stabilized after an upswing of about 30%. The prices are likely to be stable at the current levels for the near future. Though the sea freight has reduced substantially, the prices are remaining firm due to the increase in the pulp prices and lower than normal arrivals. The demand is expected to be stable.

- Duplex/Kraft: with improvement in the availability of recycled fibers, these grades have witnessed a fall in prices. The demand too seems to be subdued.

- Virgin Grades: the Market for virgin grade boards seems to be steadily growing with more and more segments preferring these grades of boards. The prices have also been firm and are likely to be firm in the near future.

- Newsprint: After witnessing a steep increase in price peaking at about 75000 per ton, Newsprint prices have softened by about 15% recently. However, the demand seems to be stable at the revised prices.

The current situation is unique in the following aspects:

- There has been a spurt in prices in the last 60 to 75 days. The increase ranges anywhere between 30% to about 70% depending on the product. The probable reasons being:

- The offtake from all convertors engaged in servicing the requirements of the educational sector had been sluggish upto March 22. Normally the publishers commence their sourcing activities during the month of October where as the note book convertors commence their sourcing from January. For the current season, the convertors were unable to predict the demand (due to the fear of Covid striking again) as a result of which the orders were not flowing upto February after which there was surge of orders from March, once there seemed to be some clarity on the normal functioning of the Education sector.

- Not withstanding the sourcing by the various Text Book Corporations who normally source paper as early as December/January also got delayed their sourcing activities due to the same reasons mentioned above. All this delay has led to steep increase in the demand of W & P grades of paper since March 22.

- Due to increased overseas demand for paper from India (at much better prices) many Paper mills seem to have accepted fairly large orders from the overseas markets.

- Poor arrivals of imported of both coated and uncoated grades due to multiple reasons like higher prices, higher ocean freight, longer lead times have also been a reason for the spurt in prices.

- The robust demand for all packaging grades of paperboards due to increased economic activities post-COVID-19 has also been a factor in the prices firming up in the recent past.

Q: Paper & paperboard exports from India hit an all-time high of Rs 13,963 crore in FY21-22, up nearly 80% year-on-year, What factors do you see working behind these jumps in export?

1. Bullish trend in Pulp prices.

2. The demand for paper and paperboards are witnessing an upswing due to the waning effects of COVID and the consequent opening of the economy

3. China has been in the backfoot due to the impact of COVID.

Q: Do you think excessive export of paper is good for the domestic market? Don’t you think that export opportunities will create price pressure in the domestic market?

Exports at the cost of domestic market is not a good sign for the domestic convertor/consumer/trader. However, we understand that most of the Paper mills have increased their share of exports. If the current international trend continues, exports will continue to surge which will most certainly keep the domestic prices quite high.

Q: Russia –Ukraine War has increased the prices of imported newsprint up to 80 percent. This is paving a way for local manufacturers to revive their newsprint production. How do you see this situation?

True. Looks like the war will be a long drawn affair! Prices of newsprint have closed to doubled and many paper mills have shifted a substantial volume to Newsprint due to better realization and benefits of economies of scale while producing newsprint. Though prices of domestic Newsprint have softened and may witness further softening in the future, the demand is likely to be stable.

Q: Govt. of India has brought the Import of Paper under Paper Import Monitoring System (PIMS) from 1st October. This order shall be applicable to a range of paper products, such as newsprint, handmade paper, wallpaper base, duplicating paper, coated paper, uncoated paper, and other grades of paper. Do you think this step will bring relief to domestic manufacturers? What is Government's intention behind PIMS?

There seem to be more negatives than positives in PIMS!

Negatives:

- Additional paper work

- Possible harassment by Government departments.

- Infringement into free trade by genuine Traders.

- Un-necessary compliances.

Positives:

- Government will have a tab on dumping of goods into India

- Unscrupulous trading activities will be restricted.

Q: Do you think that regulating the paper import may lead to market monopoly by some big paper manufacturers in the future?

No. Personally, I do not think this regulation will in any way enable large domestic manufacturers to have a monopoly. I am quite confident that the domestic regulations are good enough to prevent any unfair practices by the big players.

Q: The surge in the price of waste paper domestically is making the price of a finished paper uptick. How you do overall analyze the waste paper crisis in India? What should be the paper mill strategy in procuring the waste paper from abroad?

We have been speaking on this for quite some time. The percentage of waste paper which comes back for recycling in India is one of the lowest in the world. There is a lot which the industry can do in this regard. The industry incentivizes local bodies/NGOs to collect waste paper and reward them suitably. May be they can use the CSR funds for this purpose by which not only the community is benefitted, the industry will also stand to gain.

This apart the association of recycled mills should conduct a sustained campaign and educate the common man on the importance of ensuring waste paper comes back for recycling. They should also have a robust collection mechanism. If possible, a national recycling policy, similar to the Extended Producer responsibility implemented for plastics/e-waste to be implemented for paper as well. The producers and the government to work hand in hand to frame simple but effective laws on disposal/collection of waste paper.

It may seem a difficult task, but with the co operation of all the paper mills, local bodies, NGO, and the Government we can achieve what we desire.

Q: RFC deals in various Specialty Paper and board grades along with packaging grades, how is market growth for these grades in the coming six months, especially when Govt. is committed to banning single-use plastic from 1st July 2022?

The demand for Packaging and Speciality grades are quite robust and is likely to stay there for a long time to come.

The new central regulation on usage of single use plastic products which is likely to come in force from 1st July 2022 is likely to be a game changer. Though many states have their own legislation in this regard, there seems to be a lot of disparity between the laws of various states and there seems to be very poor implementation of these laws. With the central regulation, we are expecting more clarity and uniformity. This coupled with strict implementation will most certainly open up new avenues for consumption of paper/paperboards. In this aspect, the Paper industry is likely to face stiff competition from other substrates such as cotton, jute, glass etc., The industry should work overtime at an extremely fast pace to improvise paper in such a manner that we are able to produce relevant and practical variants that will be the best substitutes for the single use plastic products that are likely to be banned.

Q: Any message for the paper industry

Paper is and will always be a Sunrise industry. The demand will continue to increase, only that the nature of usage will keep changing continuously. The industry should be fast in adapting to the changing needs and the traders should also vigilant and align themselves with the changing trends.

USE PAPER – IT IS BIO DEGRADABLE, SUSTAINABLE AND BIO DEGRADABLE.

PAPER IS THE PRODUCT OF THE FUTURE

Web Title: “Surging exports of paper will most certainly keep the domestic prices quite high”: Mr. A. Annamalai, Director – RFC

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)