‘Ban on Single Use Plastic (SUP) created euphoria in the paper industry, but demand did not increase as was expected’

‘Ban on Single-Use Plastic (SUP) created euphoria in the paper industry, but demand did not increase as was expected’

- There have been challenges for all but few mills have been getting their requirement of wood due to inherent advantages of their location

- Licence should not be given to those plywood industries which can not demonstrate their raw material sourcing from their own plantation initiatives

- The investment decision should not be based mainly on the performance of two years period during COVID

- Few experts/users of waste paper mentioned that the domestic recovery rate of waste paper in India is about 70%?

- The imported waste paper(All grades) imported in the country in 2021-22 was 6.54 Million MT

New Delhi | 20th September 2022 | The Pulp and Paper Times:

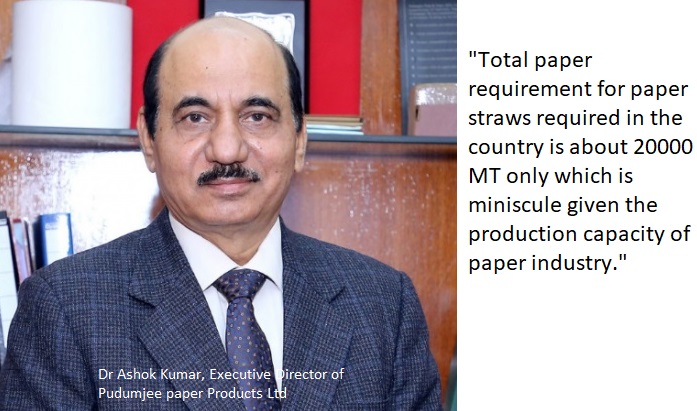

Dr Ashok Kumar, Executive Director of Pudumjee paper Products Ltd (Pune) shared his rich experience of about 40 years in the field of pulp and paper making that involves academic, research and the paper industry. He mentioned about the challenges faced by the paper industry today some of which have been there for a long time in some way or the other. Speaking at the PaperTech 2022 Conference, he shared his views about the challenges faced by the paper industry such as raw material, energy, market, profitability and sustainability etc.

He mentioned that the biggest challenge before the paper industry has been and will always be the availability of fibrous raw material, both interms of quality and quantity. There has always been the scarcity of all three types of raw material in India: wood, agro-residues and waste paper for paper making. Both the prices and availability of raw material within the reasonable distance of the mills has always been a problem.

Some of the large wood based mills have been encouraging and supporting farmers to grow plantations of Eucalyptus, Subabul, Casurina, poplar etc. The paper industry has been purchasing wood through APMCs, private contractors and directly from the farmers depending on the model existing in a given state/region. Though there have been challenges for all but few mills have been getting their requirement of wood due to inherent advantages of their location, agricultural environment in and around a given mill and, of course, the initiatives taken by the mill in its own geographical location. Most of the mills at any formal forum talk about planting more than their requirements of wood but this is far from the truth. Had this been the case, why would there be shortage of wood for papermaking? Some wood-based mills do not make efforts in growing/supporting plantations in their own area and then go to the catchment area of other mills to procure wood which not only increase prices but disturb the balance of wood availability. It is, therefore, important that all wood based mills must put in their best efforts to help farmers plant more trees in their own catchment area so that they become self-sufficient. There are also other competing uses of the plantation wood such as by the plywood industry.

They should not only be mandated to help grow plantation wood but licence should not be given to those plywood industries which can not demonstrate their raw material sourcing from their own plantation initiatives. In last Union budget, there was a welcome statement that policies and required legislative changes to promote agro forestry and private forestry will be brought in. It needs huge efforts on the part of all industry associations to partner with the Government in this endeavour which will help in providing a fillip to the efforts of the paper industry.

The wood based paper industry has also to be realistic in the sense of paying remunerative prices to the farmers because it has been seen that during any season or year of low wood supply good, the prices are lower than the expectation of farmers who in turn get discouraged and reduce plantation activities which affect the paper industry later.

The scenario is no different for agro-residues like Bagasse and straws. The issue of adequate quantity available at competitive prices is the same as in case of wood. In fact, the problem gets compounded as the agro based raw materials are seasonal in nature being annual crop available for a limited period. The agro based paper industry has to think differently now and work more closely with the farmers to ensure that the adequate quantity of the right quality is available at the affordable prices.

The waste paper scenario has been worst in last 2-3 years or so. During COVID, both the prices and availability remained a problem. Due to supply chain disruption everywhere resulting in non availability of containers and very high shipping cost, the imported waste paper prices saw the level never witnessed before. The paper and board production in India is highly dependent on the waste paper which is about 65-70 % of the total production. It will be worth mentioning here that it is very difficult to agree on any commonly accepted figure of production, waste paper consumption, recycling rate etc in our country as most of the data is derived from secondary sources without any serious exercise to validate these figures. Everybody throws some figure and depending on the convenience, the concerned expert or association takes it forward to prove any point suiting their agenda/narrative. The same is the case with the waste paper particularly the domestic availability of various grades of waste paper and their recovery rate.

In one private conversation, a few experts/users of waste paper mentioned that the domestic recovery rate of waste paper in India is about 70%?Who will believe this figure given the littering conditions of waste including paper in our country. Notwithstanding with various differing views, as per some recent document published in 2020 and some recent data of DGCI&S, the imported waste paper(All grades) imported in the country in 2021-22 was 6.54 Million MT. The domestic waste paper availability is anybody’s guess. As per EWG Report 2020 on Waste paper, about 9.6 Mn MT waste paper is recycled domestically and the rest i.e. 11.1 Mn MT directly or indirectly ends up at landfill. The data of imported waste paper is reliable as the primary source is DGCI&S but not sure about the domestic figure. Irrespective of the volume of domestic waste paper available for paper and paperboard making, the main issue is what efforts and contribution have been made by the recycle fibre based paper industry to improve collection of waste paper and ensuring its quality and quantity for future requirement. As this is the largest raw material base for paper industry, the concerned stakeholders must put in their best efforts on the ground through their respective associations to ensure the robust supply of domestic waste paperfor future paper and paperboard production.

The ban on Single Use Plastic (SUP) created euphoria in the paper industry about its future demand with replacement of plastics by paper. Though some end uses and segments saw good increase in demand for end uses like paper bags, paper cups and paper straws etc but it did not increase as was expected. There are many reasons for this. Some applications are simple and straight forward but the applications which need barrier characteristics towards oil, grease, moisture and oxygen are not so easy and the paper industry has to develop the right products for these stringent applications. The SUP ban is not effective and the main issue is the lack of intention and thus the time bound initiatives of not making the desired changes for the benefit of the ecology and environment are not seriously pursued. There was lot of hue and cry about the non-availability of paper for paper straw manufacturing. The brand owners and other end users waited till the last moment with the hope that the ban as earlier will not be implemented and due to this reason no sincere efforts were made. Just to give an example to put things in perspective, the total paper requirement for paper straws required in the country is about 20000 MT only which is miniscule given the production capacity of paper industry. The right quality of paper is available in India from several paper mills. Paper industry makes base paper for conversion into straws and not the finished straws. Therefore, there is a need to have close co-operation among brand owners, paper manufacturers, adhesive manufacturers and the straw converters. It is also true that paper based solutions are not yet available for all applications particularly where barrier requirements are stringent. However, sincere efforts are being made to develop suitable paper and environmentally friendly chemicals to develop right products for most applications. Paper industry in its own interest must work very closely with the end users/brand owners, converters, chemical suppliers and others to develop paper based solutions for applications that need higher barrier characteristics.

The theme of the seminar is “To make Indian paper Industry world class and Globally competitive”. Though the theme is good but my own view is that Indian paper industry can not be of global level in terms of size (capacity) because of main constraint of the availability of right quality of raw material at the reasonable price within vicinity of the mill as is the case of many paper producing countries in the world. But Indian paper industry can definitely aspire to be world class in respect of product quality, plant efficiencies, R&D activities, product development and sustainability. CII can play an important role in this direction by involving all stakeholders to define our aspirations and then how to achieve the same in a systematic manner. CII can prepare a document in form of compendium available to the industry how to achieve the aspirations of becoming world class and globally competitive

As regards to the future of paper industry, I am optimistic about its growth and any investment for future expansion should yield reasonable return. However, the investment has to be carefully studied and planned with emphasis on – which segment, what type of raw material, capacity, technology, sustainability etc. if some investment is made for the reasons that it should be done as others are also doing it may create problems. The investment decision should not be based mainly on the performance of two years period during COVID. The demand is expected to be good but it will fluctuate segment wise. For some sectors like kraft paper, there will be few good months and some bad months in any given year.

The challenges before paper industry will remain the same which have been there for a very long time. Some of them are : availability of quality raw material at the reasonable price be it wood, agro-residues or waste paper, higher cost of energy mainly due to coal availability and price which was not the case earlier, cheaper paper imports from low cost producer countries like China and Indonesia, market volatility due to short cycles of paper demand and supply etc., Environment, sustainability and socio-political pressure.

Overall, there is a bright future of the paper industry but all stake holders engaged in paper business must act responsibly and contribute in improving the image of the industry and ensure the sustainability of the business in every way.

Web Title: ‘Ban on Single Use Plastic (SUP) created euphoria in the paper industry but demand did not increase as was expected’

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs) Join Buy Sell Channel (Free to Submit)

Join Buy Sell Channel (Free to Submit) Paper News Headlines Channel (Free to read)

Paper News Headlines Channel (Free to read)