"Paper manufacturers can not cover the increased cost of production in tandem with the increased cost of inputs": Dr Ashok Kumar ED - Pudumjee Paper

"Paper manufacturers can not cover the increased cost of production in tandem with the increased cost of inputs": Dr. Ashok Kumar, ED - Pudumjee Paper

Highlights of the Interview:

-we have developed some products which can replace plastic-based products partially or fully depending on the application

-Some flexibility with respect to product mix will definitely come but when the operations are normalized in near future, most mills will continue to manufacture what was being manufactured before the pandemic.

-The prices of inputs increase suddenly but paper prices can not be increased like that meaning thereby.

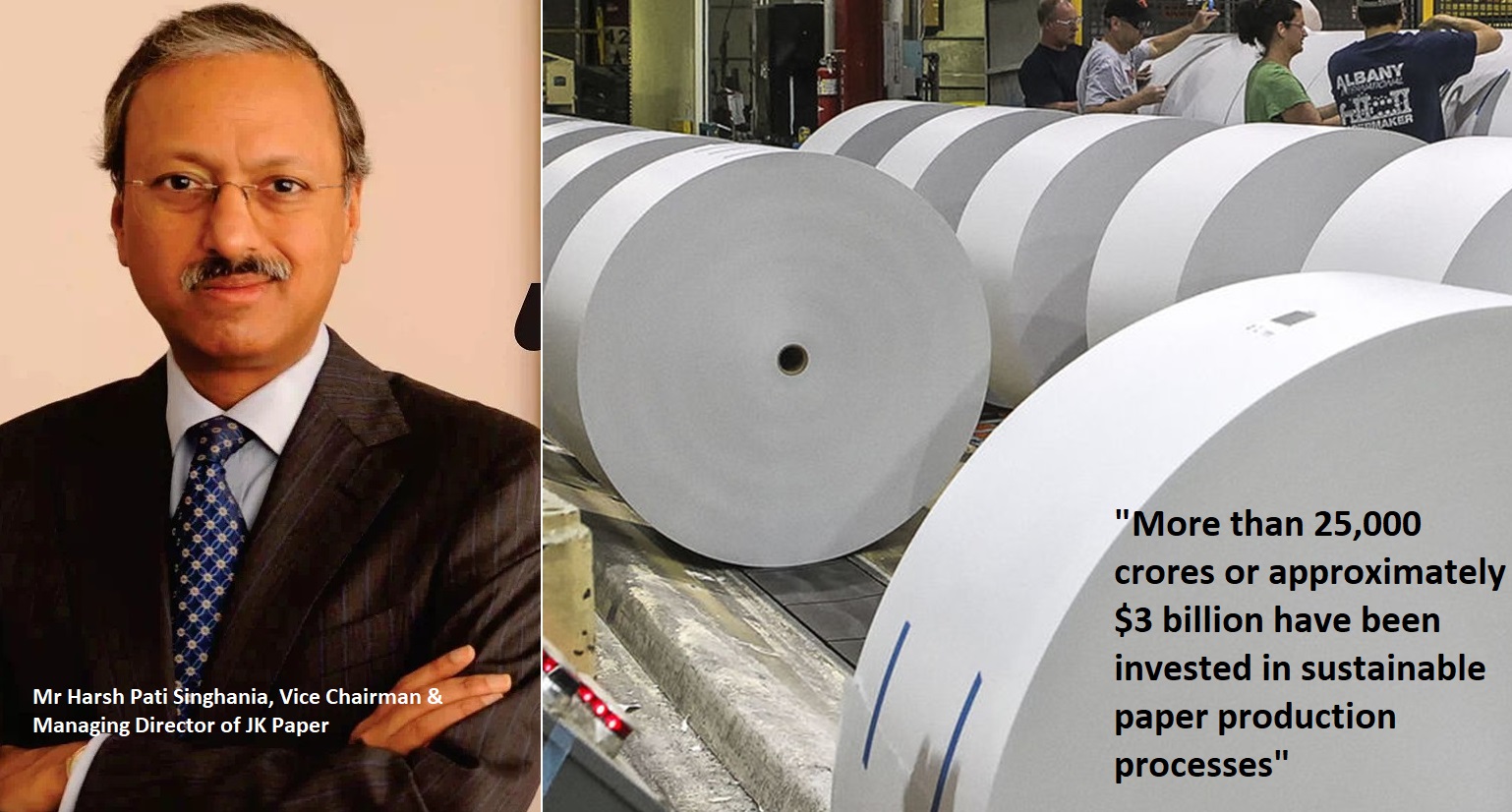

“Pudumjee†laid the foundation of their Specialty Paper business with a core belief in value creation. The business that came to the company was started with the manufacture of high quality papers to meet customers' critical and demanding requirements in packaging of food and oily products. Since inception, Pudumjee Group has stood by its core belief and commitment to the customers. PPPM, over the decades have continually expanded their products offering, pioneering many a product line in India and have established, in the market place, their name for quality and reliability.

Recently, The Pulp and Paper Times interacts with Dr. Ashok Kumar, ED – Pudumjee Paper Products Ltd. over various developments being carried out on new products in Pudujee paper and other industries issues. Here are his views:

December 2021 | The Pulp and Paper Times:

Q: What is your quick review on the present condition, post-second covid wave, markets are opened, and schools & colleges have resumed studies. Do you think the pressure on Writing and Printing paper’s demand would vanish completely in the next three to four months?

COVID-19 is one of the greatest challenges faced by the whole world and India is no exception to that. The paper industry like all other industries has also been adversely affected due to COVID-19. Though, all segments of paper industry have been affected adversely but the industry being diverse in nature, different segments and companies were affected differently.

There has been improvement in demand after post-second COVID wave due to the opening of markets and schools and colleges but there is no clear trend as yet due to uncertainty about new variant of COVID 19 virus One month looks promising but the next month looks depressing again showing that uncertainty is prevailing and it is difficult to make any future predictions with certainty. About a month ago, the demand was robust with the expectations that it will continue for the whole of third-quarter 0f FY 2021-22 but at this point of time, the demand in December, 2021 has reduced in most segments compared to October and November 2021. Earlier, the trend used to persist at least for a quarter or more but it has now reduced to a month or weeks lowering confidence about any stability of demand, supply, prices, payment cycle/conditions etc.The writing and printing paper segment started showing good recovery and the demand was good in October and part of November 2021 but it has declined again in December, 2021. About a month ago, most agencies in the media were talking as if COVID has almost disappeared from India and people at large were not even following COVID appropriate behaviour which is very disappointing. Recently, there has been report of new CORONA virus originating in South Africa and spreading across the world. As of now, there is no clarity about its impact on human health and business. This is the most important factor which will have biggest influence on businesses and our lives. It appears that the pressure on the demand of writing and printing will remain at least for 2-3 months. The only prediction that can be made at this point of time is a lack of clarity or any trend and uncertainty is prevailing.

Q: Pudumjee Paper is known for its various types of specialty paper manufacturing, what impact do you see on the demand of all grades of specialty paper post-COVID pandemic? And what new trends are emerging out due to COVID behavior being followed by people?

Pudumjee Paper Products Ltd. (PPPL) manufactures Specialty Papers for pharma, hygiene, food, decorative laminate segments etc. PPPL actually is a Specialty Paper packaging solution company. PPPL has also been hit adversely like other segments of the paper industry during COVID. The Specialty Paper segment also witnessed demand compression due to COVID-related restrictions including lockdown during Q1 and Q2 with improvement in Q3 and Q4 of FY 2020-21. There was good recovery in Q1 of FY 2021-22 with the hope that it will continue in Q2 and Q3 of FY 2021-22 but this has not been the case. The demand at present is low and cost of production has increased significantly with higher prices of inputs such as chemicals, coal, packaging material including logistic costs and uncertainty about the supplies reaching the industry in time. The paper price increase segment-wise, if any, is not able to compensate for the increase in cost of production. Also, timing is important in the sense that normally, the prices of inputs increase suddenly but paper prices can not be increased like that meaning thereby, the paper manufacturers can not cover the increased cost of production in tandem with the increased cost of inputs.

There are new trends emerging with focus on health and hygiene. There has been a significant growth in the packaging sector for past few years, which increased even more during pandemic with emphasis on products catering to health and hygiene segments.

Q: Pudumjee Paper is exploring different kinds of packagings with or without the use of paper, please throw some light on this development for our readers.

There has been significant demand to service health and hygiene segments and at the same time, there has been ban on Single Use Plastic (SUP) and increased demand for sustainable paper based products as a substitute to plastics for a variety of applications.

Paper in its natural form does not provide any barrier including to oil and grease resistance. Such barrier properties including OTR and MVTR are to be incorporated in paper with various coating chemicals. We at PPPL fully understand the role of paper and its limitations in providing packaging solutions to substitute plastic-based packaging. Without creating any hype to replace plastics, we have developed some products which can replace plastic based products partially or fully depending on the application. There are several applications where paper-based products alone meet the barrier requirements fully and along with plastic based materials reducing the requirement of plastics significantly in the final laminate. Some of the products developed by PPPLin this area are:

1. Solid Bag 40 GSM : Packaging of foodstuffs with less oil content like sandwich, burgers

2. Solid Wrap 40-120 GSM: Paper bags for packaging of wet and Oily foods like sweets & various Breakfast items, Wrapping of oily paratha, roti etc.

3. Wrap HL & Wrap Uncoated (Export) 100-150 GSM :As a stiffener inside the soap wrapper replacing the PE layer.

4. Parchmentine 40 GSM: Making of Filament winding of cones in textile industry.

5. Print Base Brown A, Timber A: As a layer for décor lamination.

6. Crystal MTW (LD) 50 GSM: For making opaque melamine tableware.

7. Nature Kraft 70 GSM: Paper based packaging and import substitute for packaging

8. S/C Kraft 80-85GSM: For Paper tapes used by prestigious customers- import substitute.

9. Bactite 60 GSM:Packaging of medical devices, Gloves, Blood Bags etc

10. Siripac 60 GSM: Packaging of medical syringes.

11. Release Liner 40-90 GSM: For Labels, Stickers, Tapes, Medical bandages, Release Liner in hygienic products like Diapers, Sanitary pad etc.

12. Bowl paper 180 GSM: For making fiber roll for Super Calendar - Import substitute

Q: During FY 2020-21 Pudumjee Paper has achieved a net profit of INR 30.03 crores as against a profit of INR 27.21 crores in the last year in spite of it being a difficult year faced by the nation owing to Covid pandemic. What strategies and planning did Pudumjee Paper adopt to manage this growth momentum?

PPPL has 4 Paper Machines (2 MF and 2 MG machines) producing various grades of MG and MF Specialty Papers. The fibrous raw material is imported softwood (SW) and Hardwood (HW) pulps and pre-consumer Tissue waste. There are no pulp manufacturing facilities at our mill.

The Company produced 68,548 MT finished paper in 2019-20. At the start of the pandemic in March / April 2020, there was no clarity about the future of business. The lockdown was imposed suddenly and there was no preparedness of any kind for anything. All of a sudden, all activities including movement of goods stopped. However, when some clarity emerged, PPPL after getting permission from Government authorities started operations on 10th May, 2020 as we produce Specialty papers for packaging of essential goods like food, pharma and hygiene segments for which permission was given.

However, the production was less than 40% in the beginning. We relooked at our product portfolio and started manufacturing only those products which were meant for packaging of essential goods. It helped us to select those products which had better demand and at the same time gave us better margins. As we use imported fibrous raw material for paper production where the delivery period is about 3 months, we at PPPL keep pulp stock of 3-4 months. Fortunately, we had sufficient pulp stock, procured at lower pricesat the beginning of pandemic. As the production was less due to poor demand, it was sufficient for a longer period than normal. Also, we did not have to reduce paper prices much like other manufacturers of copier, writing and printing papers. Due to these reasons, even though the finished paper production in 2020-21 was 65% of 2019-21, the profitability was maintained due to better overall margins.

Q: Hygiene Products, which primarily focus on Institutional Business, are facing low demand in the market, how do you see this segment demand in the coming months?

PPPL produces tissue papers - Bathroom, Kitchen Towel, Napkins and Diaper. The raw material used is imported pulp and good quality waste paper, mainly pre-consumer waste paper, most of which is imported. The tissue papers are manufactured both from Virgin pulp as well as from waste paper. PPPL also converts some quantity through its division, PHPL (Pudumjee Hygiene Products Ltd) under brand name “greenlimeâ€. However, the converted products are meant for institutional businesses and are not sold in the retail market. Due to pandemic, many institutions were closed down due to which the business got adversely affected. The imported, as well as domestic waste paper prices, have risen to an abnormally high level with the result that most of the products that use recycled paper are presently not being manufactured by us. Some products like Diaper tissue are produced where imported Virgin pulp is used. There will be some improvement in the institutional tissue business but it is not likely to be at pre-pandemic level because several companies are adopting hybrid work culture where a significant percentage of workforce operates from home and the trend is likely to continue. There has been some improvement in hospitality business due to opening of hotels, restaurants etc. but due to possibility of new variant of COVID virus, there is atmosphere of fear and uncertainty. Also, unless waste paper prices reduce and come to a pre-pandemic level, we will not be manufacturing recycled fibre-based tissue papers.

Q: Recently Directorate General of Trade Remedies (DGTR) has recommended anti-dumping duty on decor paper imports from China between $110 per MT to $542 MT. How do you analyze this step of DGTR? Do you think this duty imposition will save the domestic manufactures in long term?

Decor paper demand in India is 64,000 MT/year (2019-20). Indian manufacturers meet about 37% of the total demand while remaining 63% is met through import, of which substantial quantity is imported from China. The surge in imports from China has been supported by declining prices. During 2015-16 and 2019-20, the prices of Chinese imports reduced while during the same period, the prices from European Union increased by 10%. The cheap imports from China have adversely impacted the domestic manufacturers. While the cost of production increased by 15%, the selling price has been increased by 5% during the same period. Decreasing market share coupled with pressure on margins has made current capacities unviable to operate. There is also advantage of concessional customs duty rate which make these countries like China diverting their excessive inventory to India.

In order to provide a level playing field, the domestic industry approached Directorate General of Trade Remedies (DGTR), Ministry of Commerce & Industry for initiation of imposition of appropriate anti-dumping duty on imports of Decor paper from China to India. DGTR after following due process, recommended the imposition of anti-dumping duty on Décor papers originating in or exported from China.

The imposition of anti-dumping duty will definitely provide a level playing field and keep the domestic players compete and survive against imports. There will be possibility of investment towards capacity enhancement by the domestic industry and contribute towards Government of India’s flagship program of “Make in India†and “Aatmanirbhar Bharat Abhiyanâ€.

Q: Big paper mills are also diverting their production line to kraft paper manufacturing from writing and printing, what is the reason behind it – higher price realization in Kraft Paper or sustainability in the Kraft paper market?

Most big integrated Paper Mills do not manufacture Kraft paper, which is mainly produced from wastepaper-based mills in India. Kraft paper segment of Indian Paper Industry is highly fragmented with small capacity mills to medium-sized Paper Mills. Kraft paper is also used in variety of packaging applications with quality varying from poor used in corrugating segment (both strength and cleanliness point of view) to moderate quality Kraft paper. A small percentage of Kraft paper manufactured in India find applications in quality packaging of paper and board. Due to pandemic, there was no demand of any type of paper. The Paper Mills were desperate to find out any market segment where there was some demand. Also, due to ban on import of some waste paper grades by China, there was suddenly demand of Kraft paper. But it was not the demand of Kraft paper per se but that of unbleached waste paper based pulp. India along with some countries like Vietnam and Russia took advantage of this opportunity and started supplying Kraft paper in reels, which was used by China mainly as a source of fiber in place of imported waste paper. This was the trend even sometime before the pandemic started and not necessarily as a result of pandemic. Since there was some hope in the packaging segment, few large mills converted some capacities to manufacture Kraft paper in order to run some machines to keep the business sentiment alive. But it was not substantial by any scale of measurement and short term. The scenario will change when the markets get stabilized at the level before pandemic.

Though the Kraft paper prices saw a substantial increase and the domestic manufacturers enjoy good time for robust demand and profitability but it was up and down. After the pandemic, imported waste paper prices have gone up substantially and availability as required is not there. The domestic waste paper prices have also seen a sharp rise. This has lately affected the profitability of these Mills even if the Kraft paper prices were almost all time high.

Q: Pudumjee Paper is also importing waste paper from various countries like Scandinavia, Europe, the Americas, and South-East Asia, the procurement of imported waste paper (OCC) is becoming an issue for the domestic paper industry, prices are going up, the logistic cost is uptick and lots of new capacities in Europe and America are ready to start in the few days. How do you assess the waste paper crisis? Will it be settled to pre-lockdown level again in the coming years?

The main import of fibrous raw material by PPPL is actually imported pulp and not the waste paper. We import small quantity of waste paper, mainly pre-consumer Tissue waste which is cleaned and unprinted without any out throws except cores, which are also segregated and used in manufacturing some unbleached grades. We do not import any OCC or similar grades. In general, the prices of both domestic and waste paper have increased sharply resulting in significant increase in cost of production. PPPL does not manufacture writing and printing papers including copier paper or Kraft paper for normal packaging applications. But most waste paper based Paper Mills operating in these segments have increased paper prices to cover their increased cost of production and in fact, for most writing and printing grade papers, the prices of paper manufactured by waste paper based mills are at par or at times more than the integrated wood based Paper Mills depending on the supply and demand situation. The situation with respect to waste paper availability and the prices are not likely to improve in next few months because one of the main reasons is the uncertainty and non-availability of shipping containers.

Q: Recently, European Union has put an accidental ban on the export of waste paper to India effective from 10th November 2021. This step might disrupt the supply chain and can give momentum to waste paper prices. How do you see this entire situation?

It is learnt that the ban on export of waste paper by European Union has been a “clerical errorâ€. India is a fiber deficient country and its more than 60% paper and board production is based on recycled fibre, out of which, more than 70% is imported and significant quantity comes from European Union. It has already disrupted the supply chain and the availability of waste paper has reduced considerably which has resulted in waste paper prices going up further and reaching an unprecedented level. The domestic waste paper suppliers have taken advantage of the shortage and increased waste paper prices. However, this mistake has been noticed and it is expected that the same will be corrected soon and the ban of waste paper import from European Union will be lifted.

Q: Recently, the Government of India has come up with the norms for the enforcement of 'rules of origin' provisions for allowing the preferential rate of customs duties on products imported under free trade agreements. The primary aim of such a policy is to stop the unauthorized benefits and claims of Custom benefits under the respective Trade Agreements like FTA / PTA / CECA / CEPA). How does Pudumjee evaluate this kind of imposition particularly for paper trade? Will this rule benefit the Indian paper industry and discourage the import of paper?

The norms laid down for the enforcement of “rules of origin†primarily refer to the value addition in the country of origin for the exporter to get concessional rates of customs duty for exports to India. We first need to evaluate the countries that are exporting to India under the various FTAs. These are predominantly south East Asian countries where the paper manufacturing companies are fully integrated and the question of meeting the “country of Origin†requirement does not matter/arise as they by and large meet the requirements.

This will help the manufacturers of commodity papers in India with integrated operations. Most tariff barriers for imports from these countries such as anti dumping duties are levied on woodfree writing and printing papers as well as C1S and 2C2S coated papers.

Pudumjee is a high-value added specialty paper producer and depends on imported market pulp which is its main raw material. The general condition of the paper converting industry is that most of the equipment used by the industry is of small format with slow speed. Most of these industries use paper from “stock lots / side cutsâ€. Such paper is imported at very low prices by the paper trading community, thus affecting the profitability of the specialty paper producers. As long as the government permits the import of stock lots of paper into the country (which encourages adoption of illegal business practices such as transfer pricing/under invoicing etc), the Indian paper manufacturing industry will always be at the losing end of the equation. In fact, there should be a minimum import price levied on all grades of paper irrespective of whether they are prime or stock lots to enable domestic manufacturers to have a level playing field.

Q: Few Big paper mills of the writing and printing segment in India are more experimenting with their product mix; they are turning around from traditional product manufacturing to market-oriented products like a multi-layered board, virgin Kraft, and Cup stock. Do we think it's a transformation stage for WPP segment?

The product development and change in product mix is an on-going process in paper industry as the demand keeps on changing. But during the pandemic, after lockdown restrictions were imposed, the demand all of a sudden disappeared. Few mills out of necessity or desperation tried to change the product mix wherever it was feasible but it hardly made much of a difference. The change over is not that easy also as every machine is designed for a dedicated product for a particular market segment. For example, a paper machine that produces maplitho and copier papers can not manufacture multi layer board or vice versa. An MF machine can not manufacture MG papers and vice versa. An MF machine producing writing & printing papers can not manufacture Tissue papers. By and large, the machines are designed for a given product category and any meaningful change to a different category of product needs capital investment and time even if it is feasible. Some flexibility with respect to product mix will definitely come but when the operations are normalized in near future, most mills will continue to manufacture what was being manufactured before the pandemic.

Q: is the coal price momentum due to the shortage, has impacted the finished paper price?

The coal price almost doubled within a short period impacting all mills with regard to the availability and the increase in cost of production by about 3-4% depending on the type of mill (Mills with and withoutcogeneration facilities). During this period, most input prices increased suddenly having a significant impact on the cost of production. The paper prices as mentioned before can not be increased simultaneously as the market takes time to absorb any increase in paper prices. The coal prices have started declining and hopefully, the prices will further reduce.

Web Title: Paper manufacturers can not cover the increased cost of production in tandem with the increased cost of inputs Dr Ashok Kumar ED Pudumjee Paper

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs)