"Paper Industry will no longer be in the traditional 3-5 years of cycles": FPTA

"Paper Industry will no longer be in the traditional 3-5 years cycles": FPTA

Mr. Deepak Mittal becomes the 60th president of the Federation of Paper Traders Association (FPTA) for the year 2021-2022. Mr. Mittal shares his views on the current situation of the Indian Paper Industry exclusively with The Pulp and Paper Times. Here are his views:

9th October 2021 | The Pulp and Paper Times:

The Indian Paper Trade is at the crossroads with many challenges and opportunities staring at them simultaneously. The challenges that the trade is facing are demand disruption in the Writing & Printing Grades due to increased digitization. The trade faces instability brought about by frequent price changes. The trade feels threatened and burdened by increasing compliance resulting from numerous GST legislation changes and amendments. The trade also faces increase in working capital requirements as a result of frequent movement of prices northwards. The extended credit period has led to the rising risk of bad debts etc.

March 2021 saw the start of the second wave of Covid-19 which lasted till August 2021 end. Many parts of the country faced lockdowns for extended period of time. This impacted the demand and the supply chain as well. The domestic demand took a big hit. Educational institutions remained closed. The scholastic sector has a 60%share of the Writing & Printing Paper demand and due to educational institutions remaining shut the impact has been very severe. Offices, shops and factories were either shut or operating at reduced capacities. This also led to lower municipal and waste collection, adding to the lower availability of raw material. The availability of waste-paper, whether domestic or imported, remains a major concern in India. Paper manufacturers are dependent on imports of waste paper.

Digitization has led to the decline of print, publishing and print media. Reduction in pages, loss of advertisement revenue and downward spiral in circulation put the print media under financial stress. The consumption of newsprint in this period proves this fact.

Packaging, on the other hand, continued to do well with both containerboard and boxboard seeing growth due to rising e-commerce and need for sustainable packaging. The shift in food habits and increase in demand for ‘Take Away’ food led by startups such as Swiggy and Zomato has increased the demand for paper packaging substantially. The Covid era led to the stopping of serving hot food in the air travel and a gradual shift towards pre-packaged food in paper. This move has led to the increased demand of paper packaging.

Tissue was the rising star as its exports and domestic consumption increased due to people becoming more conscious of personal hygiene and health.

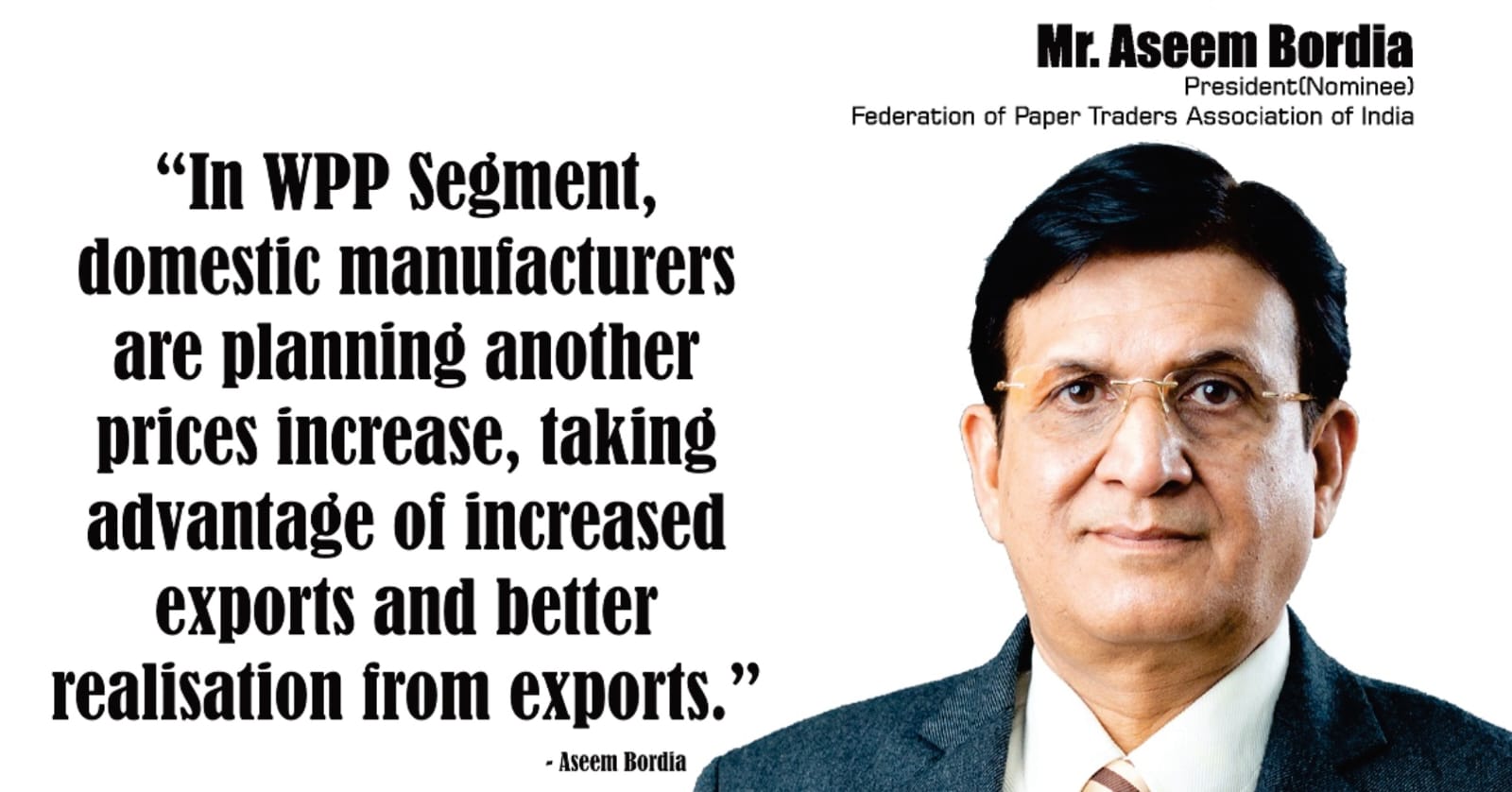

In general, the frequent changes of finished paper prices made it very hard and difficult for the trade to either convince or satisfy their existing clients. Retaining customers for the long run is becoming far more difficult, riskier and nearly impossible. Frequent price changes also lead to instability in the market and confusion among customers. The short-term approach of hourly/daily/weekly price changes was a new phenomenon and the trade is still trying to cope up but with great difficulty.

India is well on the path of recovering from the drawdown caused by two waves of the Covid-19 pandemic in the country. The Government of India is moving at a very rapid pace towards vaccinating all eligible adults by the end of this year. With the increase of vaccination among India’s population, there is a sense of certainty that the economy is already back on the path of recovery.

With recovery insight, the outlook for the medium to long term looks very promising for the Indian Paper Industry. The rules of the game are changing - Paper Industry will no longer be in the traditional 3 – 5 years cycles. The cycles will become shorter and may be one up and one down cycle in the same year. This could well be the new normal for the Paper Industry. The industry and trade will have to learn to live with it.

Reasons for this is that the supply demand gap has narrowed considerably due to demand growth in China and no new capacity addition (except Tissue)

The outlook is looking very rosy as all factors are looking favorable for a good sustainable growth story.

a) Base is small – per capita consumption of 14 Kgs (against global average of 57 Kgs)

b) India’s focus is now on manufacturing (until now it was services) which will give a big boost to the demand of Paper and Paper Board.

c) Plastic to Paper is a mega trend and could lead to huge demand in Paper & Paper Board over next 5 – 10 years.

The world is looking at China + 1 strategy and India remains to be the natural beneficiary of this scenario due to its demographics, low cost and a strong domestic market. China is 6 – 7 times India’s size even a small shift can double India’s base (120 Mn. Tons – 20 Mn. Tons)

With China clamping down on polluting industries, there is going to be a shift of paper manufacturing from China to other developing countries like India, Vietnam, Indonesia etc. It is up to us how we en-cash this opportunity.

The Indian Paper Industry is at 20 Mn. Tons p.a. which is 4 – 4.5% of the world demand with the world population of 16%. The market share is very low and bound to go up. China is at 28% of the world demand with the same population. The growth rates for the Indian Paper Industry is expected to be at 5 – 6% p.a. with Packaging growing at slightly higher rates than Writing & Printing.

In 2020, Due to the Pandemic, the Indian Writing & Printing segment shrunk approximately by 35% due to the closure of schools & colleges (as the Indian lock down was one of the most stringent lockdown compared to any other country).

This will come back very strongly in this year and next, and if we do not get another wave of the Corona Virus, we should be back on our feet from early 2022.

The time looks good for the Indian Paper Trader and the Paper Industry but we need to be cautious on long credits, bad debts, margins etc.

The Federation of Paper Traders Association of India which is the apex body of the 35 Paper Merchants Association located all over India having about 6000 Members conducted its 60th AGM on 26th September 2021. The AGM was hosted by the Karnataka Paper Merchants & Stationers Association at Bangalore. Mr. Deepak Mittal became 60th President of FPTA for the year 2021-22. He is one of the youngest Presidentsof FPTA.

FPTA was established in the year 1959 on the advice of the then Prime Minister of India, Late Shri. Lal BahadurShastri. Ever since it was established, FPTA has done yeoman service not only to its Members but to the Paper Industry as a whole. FPTA plays a vital role in propagating the fact that the paper is sustainable, recyclable and bio-degradable.FPTA was instrumental in celebrating ‘Paper Day’ on August 1st every year.

Web Title: Paper Industry will no longer be in the traditional 3 5 years cycles:FPTA

More News From paper-trading

Next Stories

Join WhatsApp Group

Join WhatsApp Group Join Telegram Channel

Join Telegram Channel Join YouTube Channel

Join YouTube Channel Join Job Channel (View | Submit Jobs)

Join Job Channel (View | Submit Jobs)